Business

Rate Cut Hopes Fade as SARB Eyes Lower Inflation Target and Budget Uncertainty

South Africa’s interest rate landscape is facing a potential shake-up, as the South African Reserve Bank (SARB) prepares for its upcoming Monetary Policy Committee (MPC) meeting next week. Despite subdued inflation and easing sentiment globally, economists believe the central bank will take a cautious approach—largely due to new talk of lowering the country’s inflation target.

After briefly enjoying a period of economic calm, analysts say the SARB is not yet ready to shift gears. While other major central banks like the European Central Bank and Bank of England have signaled their intention to ease rates, South Africa’s policymakers are expected to hold firm.

“Although inflation is well behaved and below the mid-point of the target range, the Reserve Bank has consistently taken a cautious stance,” said Maarten Ackerman, Chief Economist at Citadel.

Ackerman noted that the SARB remains laser-focused on global risks—especially US inflation trends, the interest rate differential with the dollar, and the performance of the rand—before it makes any move.

Why the SARB is Likely to Hold

Inflation in South Africa has been under control, staying within the 3%-6% target range and even dipping below it in recent months. But that doesn’t guarantee an interest rate cut.

Annabel Bishop, Chief Economist at Investec, believes the SARB will continue to err on the side of caution. Even though current inflation prints are subdued, the central bank is looking ahead and guarding against longer-term risks.

“With inflation averaging 4.5% this year, the SARB may be reluctant to cut just yet—especially with a possible change to the inflation target on the cards,” said Bishop.

While some economists, including those at Bank of America, had floated the idea of a rate cut as early as May or July, the mood has since shifted. A hold now looks more likely, especially with the national budget being re-tabled on May 21.

Lower Inflation Target Could Delay Cuts

Adding a new twist to the interest rate debate is recent commentary from Deputy Finance Minister David Masondo. He indicated that the government is considering lowering the current inflation target, possibly from 4.5% to as low as 3%.

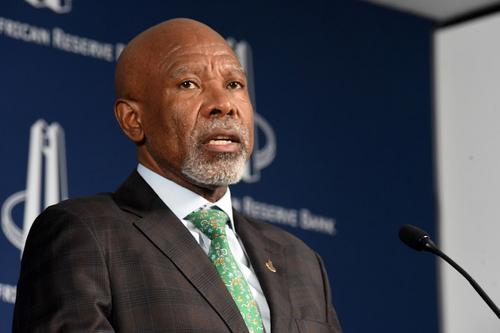

Reserve Bank Governor Lesetja Kganyago has long advocated for aligning South Africa’s inflation target with those of global peers, which tend to aim for around 2%-3%. If implemented, this policy shift could limit the SARB’s flexibility to cut rates in 2025.

Bishop said a reduced target range—say 3% to 5% or even less—would drastically reduce the chances of interest rate cuts this year.

“At the current inflation target, there’s room for one or two 25 basis point cuts. But if the target is lowered, those windows may close,” she said.

Budget and Politics Add Further Uncertainty

Aside from inflation considerations, the SARB is also keeping an eye on the upcoming budget and political developments tied to South Africa’s government of national unity.

If the revised budget, expected on May 21, reflects sound fiscal policy and unity within the ruling coalition, it could restore confidence and create space for rate cuts in the second half of the year. But if it sparks political infighting or policy missteps, it could derail those plans altogether.

Ackerman warns against expecting any bold moves.

“Even if inflation is under control, the Reserve Bank’s track record suggests it won’t act hastily. They’ve passed up earlier opportunities to cut, so a surprise move now is unlikely,” he said.

The Rand Reacts

In anticipation of a potential tightening in monetary policy—or at least a signal that rates will stay higher for longer—the rand strengthened to R17.99 to the dollar.

Economists say a narrower inflation target would widen the interest rate differential with the US, which could support further rand appreciation. This would benefit imports and help stabilise inflation.

With inflation in check and global markets steadying, some might hope for relief in borrowing costs. But the SARB appears to be sending a clear message: not so fast.

The combination of a potential inflation target cut, global uncertainties, and domestic budget politics means interest rates in South Africa are likely to stay on hold for now—with any hopes of rate relief pushed to later in the year, or perhaps even 2026.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com