Business

FSCA to Release Findings on Racial Profiling Claims Against Banks After Years-Long Probe Article Title:

The Financial Sector Conduct Authority (FSCA) is preparing to publish the findings of a years-long investigation into allegations that South African banks engaged in racial profiling and discriminatory practices. This follows heightened public concern and revelations from the Zondo Commission regarding questionable conduct within the financial sector.

While the FSCA says it found no solid proof of deliberate racial profiling or illegal discrimination, the watchdog did uncover several weak spots in how banks make decisions, handle risk, and engage with clients. These shortcomings, identified during a review that spanned from 2022 to 2024, highlight areas where banks must improve to rebuild public trust.

The issue gained attention after the Zondo Commission, which exposed deep-rooted corruption under state capture, noted that banks failed to uphold ethical standards. It was revealed that some financial institutions not only facilitated suspicious transactions but also turned a blind eye to their duty to report such activity to authorities.

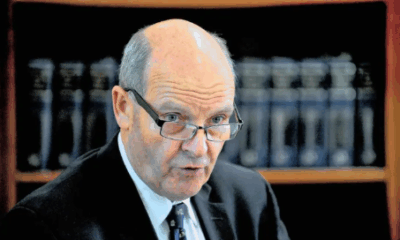

Judge Raymond Zondo, in his final report, was critical of the unaccountable power banks hold — particularly their ability to close clients’ accounts without a fair hearing, often citing vague suspicions of illegal activity. Law firm ENS Africa underscored Zondo’s point that this practice could violate basic principles of fairness and transparency.

The Zondo Commission also shone a spotlight on the Gupta family’s banking arrangements, revealing that political interference — including from former President Jacob Zuma — was used to try and stop the closure of their accounts. Zondo found this behavior breached the Executive Members Ethics Act, pointing to a broader culture of institutional manipulation.

As part of its ongoing reform efforts, the FSCA said the Conduct of Financial Institutions (COFI) Bill — which aims to overhaul how financial institutions treat customers — will soon be submitted to Cabinet for approval. The bill, in the works for nearly a decade, promises to consolidate financial conduct laws and make fairness and accountability cornerstones of the sector.

The upcoming release of the FSCA’s report is likely to prompt renewed scrutiny of the banking industry and how it balances risk management with fair and equal treatment of all clients.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com