Business

“Profits Over People?”: Minister Schreiber Blasts TymeBank Over ID Verification Fee Hike

A fiery exchange between a fintech heavyweight and Home Affairs reveals deeper tensions over digital equity and state service funding

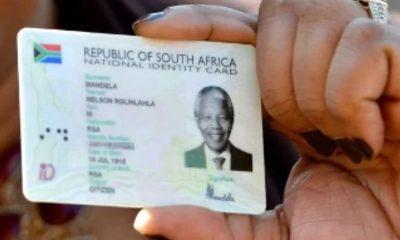

In a rare and blistering rebuke, South Africa’s Home Affairs Minister Leon Schreiber has publicly taken aim at TymeBank, accusing the digital bank of putting profits above people in the wake of criticism over the country’s newly priced identity verification system.

The row erupted after TymeBank released an open letter slamming the Department of Home Affairs’ (DHA) new Online Verification Service (OVS) fees. The service, which offers real-time identity checks via the National Population Register (NPR), is set to cost companies up to R10 per transaction—a massive leap from the previous R0.15 per check.

From 15 Cents to R10: A Blow to Inclusion or Fair Market Price?

Launched to combat system abuse and modernise state infrastructure, the new OVS pricing represents a 6,500% increase a number that caught the financial services industry off guard.

TymeBank CEO Coenraad Jonker didn’t hold back. In a public statement, he called the hike a “regressive tax on the most vulnerable,” warning it could cripple efforts to expand banking access for lower-income South Africans and jeopardise the country’s efforts to exit the FATF greylist.

“This is not just a policy shift. It undermines digital inclusion and hurts compliance efforts,” Jonker said. He appealed to national leaders, President Ramaphosa, Finance Minister Enoch Godongwana, and the SARB Governor to intervene before rollout begins on 1 July 2025.

Minister Schreiber Hits Back: “Take Your Faux Outrage Somewhere Else”

But Minister Schreiber came out swinging.

In a scathing response, he accused TymeBank of exploiting a state service for years at the expense of ordinary taxpayers. Schreiber revealed that the low-cost model had led to abuse of the system, which was contributing to downtime in Home Affairs offices.

“The CEO of a unicorn worth R26.7 billion demands that taxpayers who can’t afford food must keep subsidising it,” Schreiber said.

He lambasted Jonker for allegedly failing to even read the department’s public consultation letter and instead trying to “apply pressure from the shadows” after the comment period had closed.

“Shocking is not the new price,” said Schreiber, “but that you paid 15 cents for years, relied on public funds to cover the real cost, and are now crying foul.”

The minister framed the pricing revision as a national security imperative saying failure to invest in the NPR would eventually cripple the country’s ability to manage identity security.

The Broader Debate: Who Should Pay for Digital Infrastructure?

This bitter exchange isn’t just about one bank or one fee it’s exposing South Africa’s deeper digital growing pains.

For years, public services like ID verification have been heavily subsidised. Now, as the government tries to upgrade digital infrastructure and push back against exploitation, the question becomes: who should pay?

TymeBank argues that pricing small players and start-ups out of essential services undermines financial inclusion. Meanwhile, Home Affairs insists it’s unsustainable for taxpayers to foot the bill for billion-rand corporations.

Critics on X (formerly Twitter) are divided.

One user wrote, “TymeBank is right this hurts the poor. It’s another barrier to entry for small businesses.” Another countered, “Sorry, but you don’t build state capacity with charity. These services cost something.”

Where Do We Go From Here?

With the new fees set to kick in from 1 July 2025, businesses, especially in fintech and telecoms, are scrambling to adjust their customer onboarding models. Some may pass the costs to customers. Others may scale back verification services, potentially stalling KYC processes.

Unless there’s high-level intervention, it’s clear the DHA won’t be backing down.

And with Minister Schreiber drawing a hard line on “profiteering over people,” this saga may signal a new era where the state demands market-value compensation for the digital services it provides.

In the meantime, South Africans, especially the unbanked may find themselves caught in the crossfire of a debate that affects more than just profit margins. It affects who gets to participate in the digital economy, and at what cost.

{Source: My Broad Band}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com