News

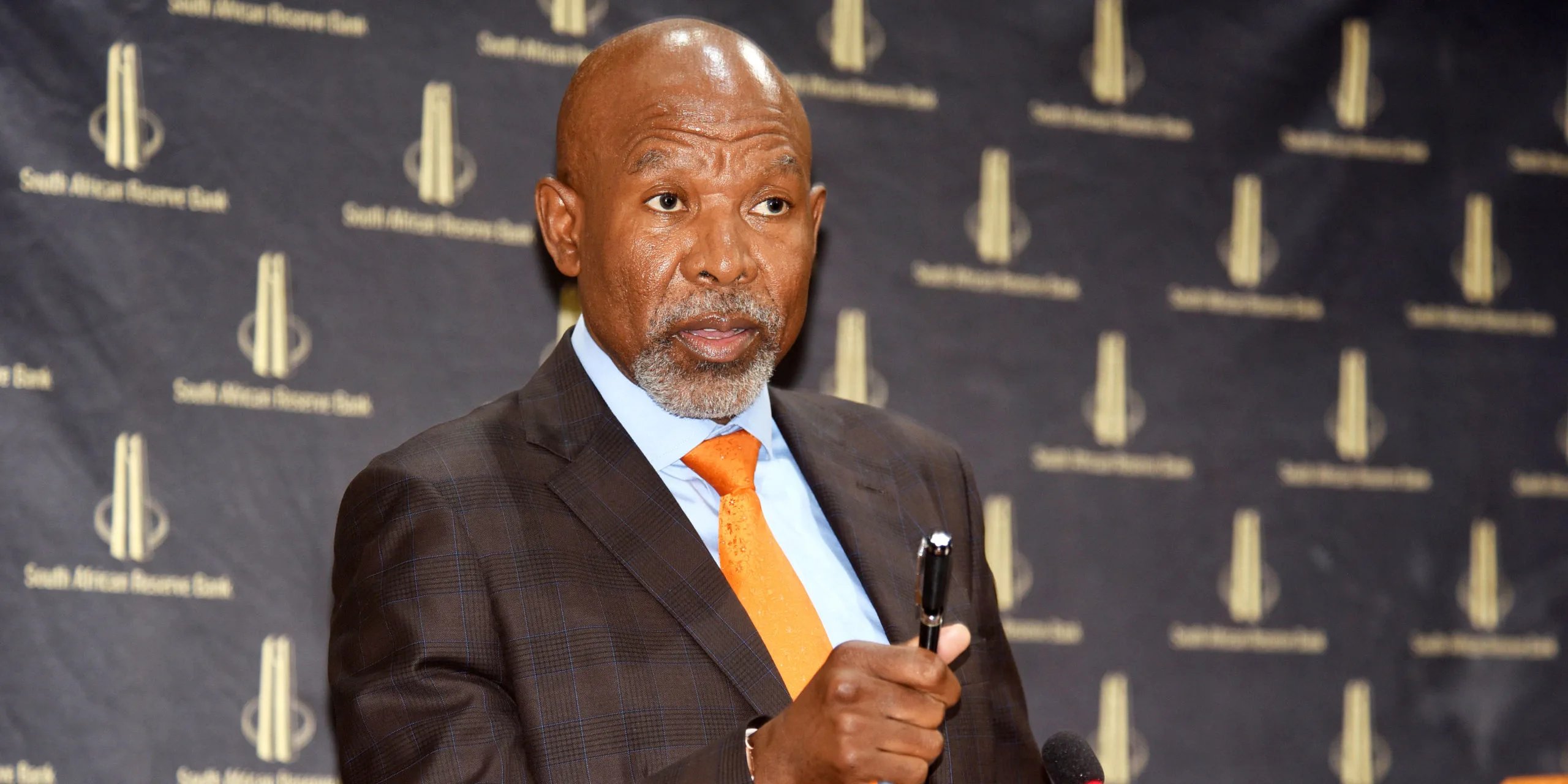

Kganyago’s Wake-Up Call: South Africa Faces a Storm, and the Easy Ride Is Over

No more free ride: The world has changed, and so must South Africa

South Africa has enjoyed a relatively favourable spot in the global economy for the last 30 years, but Reserve Bank Governor Lesetja Kganyago says that era is over. In a serious warning delivered through the South African Reserve Bank’s 2024/25 annual report, Kganyago painted a sobering picture of a world that is becoming less open, less prosperous and far more volatile.

And for South Africa, he says, the consequences could be brutal unless urgent domestic reforms are implemented.

From global boom to global bust

Over the past three decades, South Africa benefitted from the tailwinds of globalisation, strong commodity demand, capital inflows and access to major export markets. It was a world order that made it easier for developing economies like ours to ride the wave.

But that wave is crashing.

“The world is moving towards a more fragmented and less growth-friendly state,” Kganyago said. Trade tensions are on the rise, and the global economy is no longer the reliable engine it once was. One of the clearest signals? Donald Trump’s return to tariffs.

Starting August 2025, the U.S. will impose a 30% tariff on imports from South Africa, targeting major sectors like automotive and agriculture. With the United States being South Africa’s second-largest trading partner, the knock-on effect could be an economic gut punch.

Ramaphosa’s reassurances fall flat

President Cyril Ramaphosa has attempted to calm nerves, hinting that there may still be room to negotiate Trump’s tariffs down. But with Washington increasingly leaning into economic protectionism, there’s little certainty.

For a small, export-driven economy like South Africa, this is more than bad news—it’s a serious risk to growth, jobs and investor confidence.

A fragile local economy makes matters worse

Kganyago didn’t mince words about the domestic picture, either. Growth remains stubbornly low, with GDP expanding by just 0.5% last year. The country’s debt-to-GDP ratio is on track to hit 74.3% a level that, while not yet catastrophic, leaves little room to manoeuvre if external shocks hit.

Despite the National Treasury’s plan to run primary surpluses over the next three years, investor patience is wearing thin.

As Allan Gray’s Jithen Pillay pointed out recently, even if South Africa gets everything right locally, a sluggish global economy still limits the upside. And over the last decade, the country has averaged just 0.8% annual GDP growth, with GDP per capita growth close to zero.

But not all is lost: Some bright spots remain

In a rare moment of optimism, Kganyago highlighted a few reasons not to give up hope.

-

The floating exchange rate, in place for over 25 years, provides flexibility in absorbing shocks.

-

South Africa’s inflation targeting regime remains credible and effective.

-

The SARB’s own position is rock solid, with record foreign reserves and strong capital buffers.

In uncertain times, predictability becomes a premium, Kganyago noted and South Africa’s central bank remains one of the few institutions offering that sense of stability.

Editorial: Why Kganyago’s message matters now more than ever

Kganyago’s tone isn’t alarmist, it’s realistic. And that’s what makes it powerful. He’s not warning us about a financial collapse tomorrow; he’s warning about a slow suffocation of opportunity if we don’t act.

With global headwinds getting stronger and political uncertainty at home, the margin for error is razor thin. The days of blaming poor growth solely on external factors are over. It’s time to confront the hard truth: South Africa is running out of excuses.

The call now is not just for policymakers, but for businesses, unions, and ordinary citizens: demand better governance, support reform, and resist the urge to retreat into denial.

The world is no longer handing South Africa any favours. And as Kganyago makes clear, we’re out of time for complacency.

{Source: Daily Investor}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com