News

Goodbye Green ID Books: South Africa’s Digital Identity Shift Begins

Home Affairs wants to end green ID books for good. Here’s what it means for you.

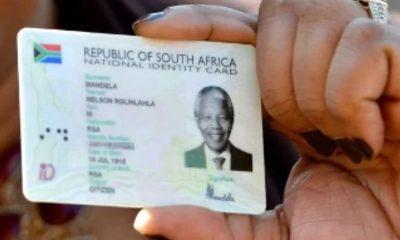

For generations of South Africans, that little green booklet tucked away in a drawer or folded into a plastic cover, has been a rite of passage. The green barcoded ID book, introduced in 1986, has been used to open bank accounts, vote, get married, and prove who we are. But its time is almost up.

Home Affairs Minister Leon Schreiber is spearheading an ambitious plan to completely phase out the outdated document, calling it the most defrauded form of identification in Africa. And with 18 million people still holding onto their green books, the race is on to modernise the system.

Why are green ID books being scrapped?

Put simply: fraud.

Schreiber didn’t mince words in a recent DA podcast interview, calling the green ID book a security liability. It’s frequently tied to identity theft, especially in sectors like finance and banking. “It’s the weakest link in our identity system,” he said.

And yet, part of the problem lies within the department itself. Roughly a quarter of South Africa’s 430 Home Affairs branches still issue only green ID books because they haven’t been upgraded with Smart ID capture technology.

That’s changing, fast.

A new digital vision: Smart IDs for all

Schreiber’s plan is rooted in two things: technology and partnerships. By rolling out a new digital live capture system, Home Affairs aims to bring Smart ID capabilities to hundreds more branches, including rural areas. The goal is to stop issuing green books this year and eliminate them entirely by 2029.

Here’s the roadmap:

-

By March 2026: 100 more bank branches will offer Smart ID services

-

By March 2028: Another 1,000 branches come online

-

By end of 2029: Green ID books are completely discontinued

Banks are the blueprint

One of the most innovative parts of the plan is expanding the partnership with South African banks. At the moment, only 30 bank branches nationwide let you apply for Smart IDs, a model that works, but hasn’t scaled.

The biggest obstacle? Human resources. Home Affairs only has 40% of the staff it needs, and the current model relies on Home Affairs personnel managing systems inside bank branches.

Schreiber has a solution: integrate Home Affairs systems directly into banks’ digital platforms. Most banks already use Home Affairs verification for things like FICA, so the backend connection exists. What’s missing is the front-end access.

“All you need is a camera and a fingerprint scanner,” Schreiber said. “It’s far safer to do so digitally than to have a person there.”

Imagine applying for your ID through your bank app

Yes, that’s the future Schreiber envisions. A world where you won’t need to brave the long queues at Home Affairs—because your local bank branch or even your smartphone will bring the department to you.

This could revolutionise how citizens interact with government services. After all, South Africans already use banking apps to pay for electricity or renew car licenses. Why not apply for an ID too?

‘Home Affairs at Home’

That’s the catchphrase the Minister is pushing. And it might be the most exciting part of the entire plan. It suggests a fundamental rethink of how state services are delivered, one where your data is secure, decentralised, and accessible without bureaucracy.

But the road ahead won’t be easy.

The digital divide still looms

Access to Smart ID services remains heavily skewed toward urban areas. Expanding digital infrastructure to townships and rural communities will be critical. And if the department fails to deliver on access, the very people who most need protection from fraud will remain vulnerable.

Still, this moment feels like a turning point.

For many South Africans, the green ID book was more than just paper, it was proof of belonging. But in an age of biometric security and rising identity fraud, nostalgia won’t cut it. What’s needed is a secure, scalable system that keeps up with the demands of a digital world.

And finally, some advice:

If you’re one of the 18 million still holding onto that green ID book, it might be time to swap it for a Smart ID. The queues may be long now, but the future promises shorter ones or none at all.

Need to upgrade your green ID book?

Visit ehome.dha.gov.za to apply or check available bank branches offering Smart ID services. Keep an eye on announcements for new branches opening near you.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com