Business

South Africa Eyes Rate Cut as Trump’s Tariff Deadline Looms

As US deadline for trade deals nears, the SARB prepares a final economic boost

South Africa’s economic policymakers are in a high-stakes sprint. On Thursday, the South African Reserve Bank (SARB) is widely expected to deliver another interest rate cut, possibly the last one for a while, as the country stares down the barrel of new US trade tariffs.

It’s not just any cut, it’s a strategic move to cushion the local economy from the shock of a 30% tariff the US, under President Donald Trump, is threatening to slap on South African exports unless a bilateral trade deal is reached by Friday. This tariff is triple the current global average and could slam key sectors like agriculture and automotive manufacturing.

A Fragile Economy in Need of Support

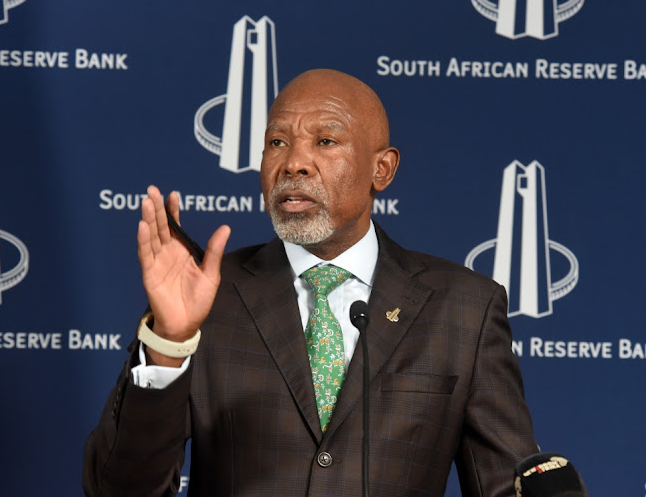

Governor Lesetja Kganyago is set to announce the monetary policy committee’s decision shortly after 3 p.m. on Thursday. Most economists surveyed by Bloomberg anticipate a 25-basis-point cut, lowering the benchmark interest rate from 7.25% to 7%.

Traders agree, pricing in an 84% chance of a cut.

Independent economist Elize Kruger says this might be one of the last chances SARB has to inject life into an economy expected to grow less than 1% this year.

“There’s a bit of room on the monetary side to still stimulate the economy without being unnecessarily brave,” Kruger explains. “We’ve had low inflation for nine months, and high rates are choking growth.”

The Reserve Bank’s own estimates suggest the proposed US tariffs could shave 0.6% off GDP and cost South Africa up to 100,000 jobs — particularly in agriculture and car manufacturing. Inflation, which has been behaving itself within the SARB’s 3%-6% target range, could tick upward by 0.4% due to the tariffs.

A Tough Call for Policymakers

While a unanimous vote from the six-member MPC is expected, some economists think the Bank may hold off.

Keabetswe Mojapelo, a macroeconomist at Rand Merchant Bank, believes the SARB might choose caution.

“When there’s uncertainty and you’re trying to manage risk, you don’t react to what you don’t know,” she says. “They might want to wait and see what the fallout from the tariffs looks like.”

But there’s another layer of complexity: SARB is also reviewing South Africa’s inflation targeting framework, a process that hasn’t happened in over 25 years. If those inflation targets shift, the Bank may have fewer opportunities to cut rates in the near future.

Patrick Buthelezi from Sanlam Investment warns this might be SARB’s last shot. “The window for cutting is closing,” he says. “This may be the final opportunity before the focus turns to absorbing shocks.”

What’s at Stake for South Africans?

For ordinary citizens, this isn’t just central bank jargon, it’s about the cost of living, jobs, and whether small businesses can stay afloat.

South Africans have been grappling with rising electricity costs, high interest rates, and load shedding. The promise of slightly lower borrowing costs could bring relief, especially for those with loans or mortgages.

But the bigger worry is what happens if Trump’s tariffs kick in. Already, there’s anxiety on local social media about the potential for job losses, especially in farming towns and auto manufacturing hubs like Eastern Cape.

“We’re barely surviving out here,” one X (formerly Twitter) user posted. “If they mess with our car exports, we’re done.”

A Make-or-Break Week for SA’s Economy

This moment is more than just a rate cut, it’s a turning point.

The SARB is trying to walk a tightrope: stimulate growth, manage inflation, and prepare for a potential trade war all while reviewing its long-standing inflation goals.

The US deadline adds pressure, but South Africans have seen this dance before. In 2018, trade tensions with Washington threatened AGOA benefits. This time, the stakes might be higher, and the cushion thinner.

Whether SARB cuts or holds, one thing’s clear: the economy needs more than monetary policy to recover. Trade diplomacy, energy reforms, and decisive leadership will be just as important.

Because if 2025’s taught us anything so far, it’s that global politics can hit local wallets faster than you think.

{Source: Moneyweb}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com