News

South Africa’s Gambling Boom: A Silent Crisis Fueled by Lockdowns and Betting Apps

South Africa, We Have a Gambling Problem And It’s Growing Fast

South Africans have always known how to take a chance, whether it’s Lotto tickets at the corner shop or a flutter on the Durban July. But something has shifted and the numbers tell a story far more troubling than a night out at the slots.

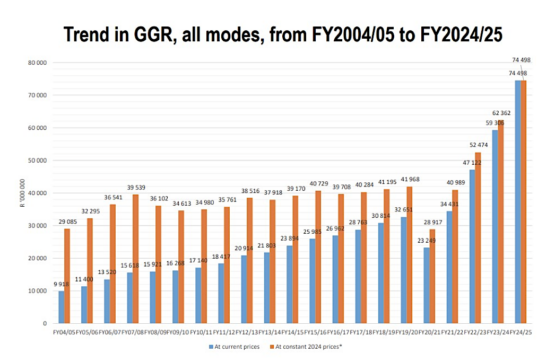

Since the Covid-19 lockdowns, gambling in South Africa hasn’t just grown, it has exploded. After a sharp 28% dip in 2020, the industry has roared back with a 220% increase in gross gambling revenue. And that growth isn’t coming from the usual suspects like casinos.

From Casino Chips to Cellphone Slips

Before the pandemic, gambling revenue had been fairly flat for over a decade. But lockdown boredom and aggressive advertising by betting apps turned the industry on its head.

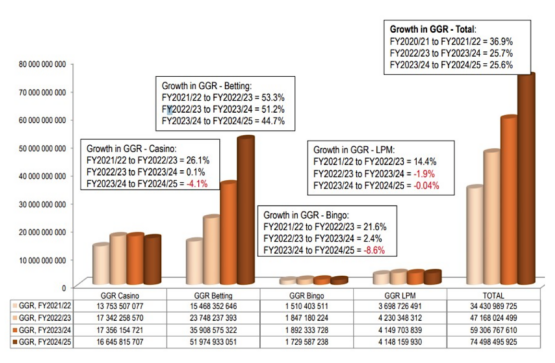

Here’s how the different sectors have shifted:

-

Betting on sport, horse racing and contingencies has become the juggernaut, climbing 53% in 2022 and another 45% by 2025.

-

Casinos, once the pride of Montecasino and Sun City, are shrinking from 26% growth in 2023 to a 4% decline in 2025.

-

Limited payout machines (LPMs) stalled completely in the past year.

-

Bingo dropped by 8.6% in 2025 after an earlier spike.

The faces of the boom? Two names dominate pavements, billboards and your Instagram feed: Hollywoodbets and Betway.

Researchers at InfoQuest found that:

-

62% of gamblers now place bets online,

-

The average online punter places 11 bets a month, and

-

Sports betting is more popular than casino slots among younger bettors.

Lottery still tops participation, but it’s no longer the most profitable space.

R1.14 Trillion In Turnover, But Who’s Winning?

The National Gambling Board says the total gambling turnover hit R1.14 trillion in 2024, up from R815 billion the year before. That’s a 40% jump in 12 months.

But here’s the catch:

Most of that money circulates back to players, about 95% is paid out as winnings. Operators keep the remaining 5%, but that sliver represents billions in profit.

And not all of that business is even accounted for, offshore betting platforms aren’t reflected in these stats at all.

‘I Need the Money’: Why South Africans Gamble

When gamblers were asked why they bet:

-

25% said they’re hoping for extra money to survive.

-

21% believe a big win would change their family’s life.

This isn’t just entertainment for many, it’s economic desperation with a glossy user interface.

TikTok Promos and Social Media Flex Culture

Scroll through X or TikTok on a Friday and you’ll find betting slips posted like fashion hauls. Influencers pose with branded caps and sponsored predictions. Hollywoodbets jerseys appear in township five-a-side matches, kasi taverns, and amateur leagues.

For younger South Africans, betting isn’t something done in a smoky casino it’s done on your phone between WhatsApps.

Business Feels the Burn

It’s no longer just moral panic, corporates are sounding alarms.

In its 2025 annual report, Famous Brands, owner of Steers, Debonairs and Wimpy warned that betting apps are draining the same spending money once used for takeaways and family outings.

The report puts it plainly:

Online betting is “capturing a growing share of discretionary budgets”, especially among the lower- to middle-income households.

Even Capitec raised concerns last year over a spike in gambling transactions affecting loan affordability.

The Law Isn’t Keeping Up

South Africa’s gambling legislation is stuck in 2004, long before smartphones put casinos in our pockets. Parliament has floated restrictions on advertising, but none have become law.

Why the delay?

Many suspect lobbying influence. The stakes are high: Betway’s South African arm alone might account for a third of the entire betting market, according to amaBhungane.

One of Betway’s biggest beneficiaries is South African billionaire Martin Moshal, who indirectly controls nearly half of its parent company, Super Group.

The Human Cost Behind the Boom

Gambling counsellors report more people seeking help, but most don’t, until the electricity is cut or rent is unpaid.

Stories on social media describe:

-

parents using child grants to bet on football,

-

students losing NSFAS allowances on accumulator slips,

-

breadwinners hiding debts from families.

And remember: these numbers don’t even count offshore betting.

Where To From Here?

If government doesn’t step in soon, the country may be forced into “damage control” instead of regulation. What started as lockdown escapism has turned into a structural shift in how South Africans spend, socialise and spiral into debt.

The question isn’t whether South Africa has a gambling problem.

It’s how long before we treat it like one.

SA gross gambling revenue 2005-2025

Source: National Gambling Board

Growth in gross gambling revenue by gambling mode

Source: National Gambling Board

{Source: Moneyweb}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com