News

South Africa’s Cigarette Market Hijacked by Criminal Syndicates: R75% Now Illicit

SA’s Cigarette Market in the Grip of Criminal Syndicates

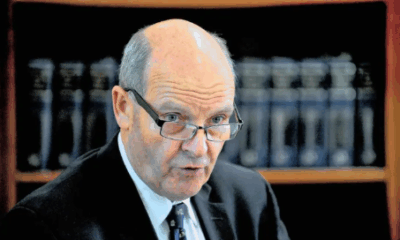

South Africa’s legal cigarette market is in crisis. According to South African Revenue Service (SARS) commissioner Edward Kieswetter, a staggering three-quarters of all cigarettes sold in the country now come from illicit sources, costing the fiscus billions in lost excise tax and threatening the stability of the economy.

Independent research from the University of Cape Town, Ipsos, and Tax Justice SA shows the illicit market has surged from 19% in 2014 to 75% in 2025, with SARS alone losing R84 billion in tax revenue between 2020 and 2022.

Kieswetter told Parliament that criminal syndicates are now operating on an industrial scale, using sophisticated financial networks, shell companies, and complicit actors across banking, logistics, and property sectors. Some networks even launder money through gold refineries and offshore investments in the UAE and the UK.

How It Got This Bad

SARS traces much of the problem to a weakening of enforcement capacity between 2014 and 2018, during the Jacob Zuma presidency, which coincided with internal disruption and oversight failures. During that period, illicit market share jumped from 30% to over 50%, while excise revenue stagnated despite rising tobacco consumption.

Since 2019, SARS has been rebuilding its enforcement capabilities, introducing intelligence-led audits, data-driven risk profiling, and modern technology to monitor manufacturing plants. Between April 2024 and September 2025, SARS conducted 576 seizures valued at R265 million, suspended multiple manufacturing licences, and referred 86 criminal cases for prosecution, resulting in R6.1 billion in recoveries and three custodial sentences of up to 10 years.

Kieswetter is calling on Parliament to approve funding for 300 additional excise officers and 100 auditors, warning that without reinvestment, South Africa’s tax system will continue to hemorrhage.

Syndicates, Borders, and Spaza Shops

The South African Police Service (SAPS) now considers the illicit cigarette trade a “national priority threat”, driven by organised syndicates rather than opportunistic smugglers. These syndicates span five tiers: financiers, manufacturers, smugglers, distributors, and dealers, often linked to drug trafficking, human smuggling, and money laundering.

Key source countries include Zimbabwe, Mozambique, and Botswana, with compromised border posts such as Beitbridge, Lebombo, and Skilpadshek serving as entry points. Tactics include smuggling, misdeclaration of goods, counterfeiting, and in-transit diversion. Informal retail outlets, particularly spaza shops run by foreign nationals, play a central role in distribution, supported by covert manufacturing and transport networks.

Weak border infrastructure, corruption, low penalties, and socioeconomic vulnerabilities have allowed the trade to flourish, leaving enforcement struggling to keep pace.

Intelligence-Led Crackdown

To counter the illicit trade, the Hawks and SAPS crime intelligence have launched an intelligence-driven enforcement strategy. Since April 2024, investigations have led to 68 arrests, 17 convictions, and R15.1 million in asset forfeiture orders. Authorities have also confiscated 50 vehicles, including trucks and trailers, used to transport contraband cigarettes.

Lieutenant-General Maropeng Mamotheti emphasised that the illicit cigarette trade is now a microcosm of South Africa’s broader criminal economy, making it a crucial battlefield in the fight against organised crime and tax evasion.

Why This Matters

Beyond the lost revenue, the illicit cigarette market is intertwined with larger criminal networks, undermining economic stability, public safety, and legal businesses. For ordinary South Africans, this means higher taxes, inflated prices on legitimate products, and the risk of unknowingly buying counterfeit goods that can be hazardous to health.

The message from SARS and SAPS is clear: without serious reinvestment in enforcement, South Africa risks losing billions more to criminal syndicates embedded in the tobacco trade.

Quick Snapshot:

-

75% of cigarettes in SA now illicit

-

R84 billion lost to excise tax between 2020–2022

-

Syndicates span finance, manufacturing, smuggling, distribution, and retail

-

Borders, spaza shops, and low penalties fuel the trade

-

SARS and Hawks using intelligence-led enforcement with notable recent convictions

{Source: The Citizen}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com