News

Exiting the Greylist: A Milestone, Not the Finish Line

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com

Published

3 months agoon

“This is a milestone that improves credibility, lowers transaction costs, and smooths cross-border transactions,” says Sanisha Packirisamy, chief economist at Momentum Invest. She cautions, however, that it does not automatically trigger economic growth.

South Africa was greylisted in February 2023 for failing to meet FATF standards on combating illicit financial flows, terrorist funding, and threats to the integrity of the global financial system. While the listing raised concerns, markets largely anticipated the outcome, and financial stability was maintained during the period.

“By late 2024, investors had already priced in the likelihood of delisting,” note legal experts Lenee Green, Lerato Lamola, and Michael Denega. “Credit analysts viewed the greylisting as a transitory compliance risk, not a structural credit issue.”

During greylisting, domestic institutions faced higher compliance costs, including regulatory penalties and extra scrutiny from foreign partners. Now, these measures remain in place, but the perception of risk has diminished.

Financial experts say the exit signals an improved environment for foreign investment. Philip Robotham of Schroders explains that delisting makes it cheaper and easier to do business, thanks to corrected deficiencies, better financial crime detection, and enforceable compliance standards.

Momentum continues as South Africa builds on other positive developments, including energy stability and enhanced public-private sector engagement. Professor Raymond Parsons from NWU Business School notes that delisting removes a key policy uncertainty, improving investor confidence and lowering costs for international transactions.

Reputation management expert Tshepo Matseba describes the exit as a reputational inflection point. He emphasizes that trust in South Africa must be treated as national equity, maintained through credibility, consistency, and competent governance.

Market reactions were muted but positive. Analysts point out that while the exit does not resolve all economic challenges, it signals a clear commitment to reform, strengthening South Africa’s case as a destination for sustainable, long-term investment.

Experts caution that continued vigilance is required. Compliance alone does not guarantee growth, but it lays the foundation for a more resilient financial system. South Africa’s next challenge is to turn this milestone into lasting economic benefits, keeping both domestic and international investors confident in the country’s stability.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com

Tshwane Sets Final Deadline As Unclaimed Impounded Vehicles Face Crushing

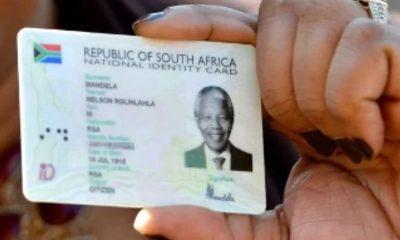

South Africa’s Digital IDs Set To Launch Before Year-End As Government Pushes Bold Tech Shif

Pretoria Steers under fire after staff made to do gardening work

Vaal school crash reopens wounds left by Pongola tragedy that killed 22

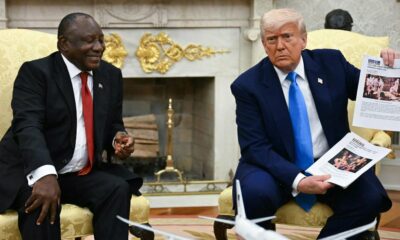

Trump repeats debunked ‘white genocide’ claims while singling out South Africa

Godongwana sounds alarm on trade war risks as South Africa courts investors in Davos