News

The Big Short’s New Target: Michael Burry Alleges a $176 Billion Tech Accounting Fraud

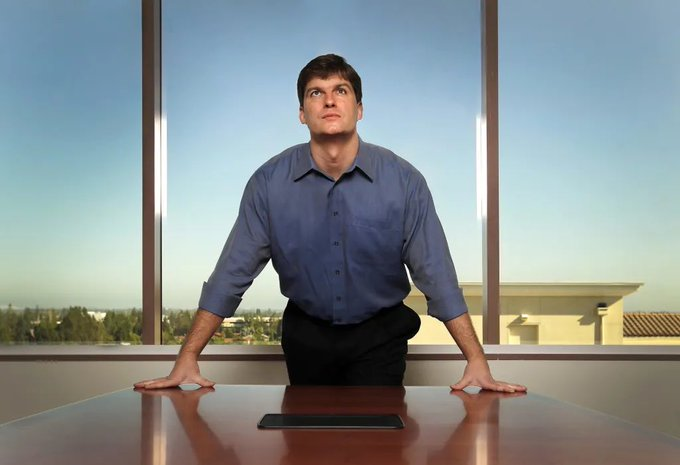

Michael Burry has a habit of seeing what others miss. The investor, immortalized by Christian Bale in The Big Short for his prescient bet against the 2008 housing market, is now turning his skeptical gaze toward the soaring world of Big Tech and artificial intelligence. His latest accusation is as bold as it is alarming. He claims the industry is built on a foundation of accounting tricks that amount to fraud.

At the heart of Burry’s argument is something seemingly mundane: depreciation. For the tech giants known as hyperscalers companies like Microsoft Azure, Amazon Web Services, and Google Cloud this boring accounting practice is the key to his entire thesis.

The Depreciation Deception

When a company buys expensive equipment, it doesn’t write off the entire cost in one year. It spreads the cost over the asset’s “useful life.” Burry alleges that these tech companies are artificially extending the stated useful life of their AI servers and Nvidia chips.

Here’s why that matters. If you claim a server will last six years instead of three, you only write off half the cost each year. This instantly makes your annual profits look larger. Burry calls this “one of the more common frauds of the modern era.”

He argues this makes no logical sense. These companies are on a frantic spending spree, buying billions worth of Nvidia hardware on a 2-3 year product cycle. Yet, they are simultaneously claiming their older equipment is lasting longer. “Massively ramping capital expenditure… should not result in the extension of useful lives of compute equipment,” he stated. By his calculations, this sleight of hand will let them understate depreciation by a staggering $176 billion between 2026 and 2028, artificially inflating their earnings by up to 27%.

The Obsolete Chip in the Room

Burry bolsters his claim with a lesson in tech obsolescence. He points out that Nvidia’s older A100 chips are dramatically less efficient than the new H100 models, consuming two to three times more power for the same task. Nvidia’s next-generation Blackwell chips promise another massive leap in efficiency.

His point is brutal in its simplicity: in the cutthroat world of cloud computing, where electricity is a huge cost, running on outdated hardware is a fast track to losing customers. A server that is physically functional can be economically obsolete. Keeping it on the books as a valuable asset is, in his view, a fiction. It’s like an airline claiming its old, gas-guzzling jets are as valuable as new, fuel-efficient models just because they can still fly.

A Circular Fantasy

Beyond depreciation, Burry points a finger at what he calls “circular investing.” He suggests the AI revenue ecosystem is not a healthy flywheel but an incestuous loop. Many of the startups and companies buying cloud AI services are themselves funded by the very venture arms of the tech giants or are engaged in reciprocal deals.

“True end demand is ridiculously small,” he tweeted. “Almost all customers are funded by their dealers.” This creates a mirage of demand, where money moves in a circle, making the entire market look more robust and profitable than it truly is.

While the tech world buzzes with excitement over AI’s potential, Michael Burry is reading the fine print. And he believes he has found the catch. He has promised more details to come, leaving the market to wonder if this is the first crack in the foundation of the AI gold rush.

{Source: TimesLive}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com