News

Venezuela’s Oil Moment: Why the US Move Has the World Watching

When Oil Became the Story Everyone Was Talking About

In early January 2026, Venezuela’s oil industry once again found itself at the centre of global attention. Following major political developments in the country and renewed pressure from Washington, control over vast quantities of Venezuelan crude became a focal point in a widening geopolitical standoff.

What followed was not just a shift in oil logistics but a move that reshaped conversations around sovereignty, sanctions, and the future of one of the world’s most resource-rich nations.

A Major Shift in How Venezuelan Oil Is Handled

US President Donald Trump announced that Venezuela’s interim authorities would transfer between 30 million and 50 million barrels of previously sanctioned crude to the United States. The oil is set to be sold at global market prices, with the proceeds managed by the US government.

The arrangement, potentially worth up to three billion dollars, marks a significant escalation in US involvement in Venezuela’s energy sector. It forms part of Washington’s broader effort to unlock oil supplies that had been effectively frozen due to sanctions and storage bottlenecks, leaving millions of barrels sitting idle.

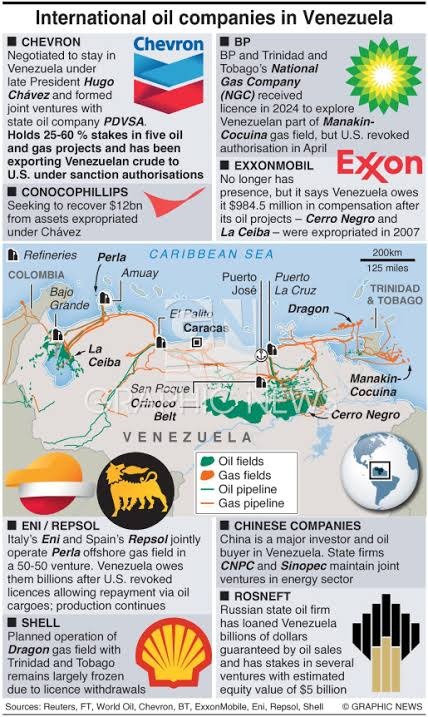

International Oil Companies Watch Closely

International oil companies with historical or existing interests in Venezuela are now paying close attention. With Washington playing a more direct role in oil management, the future participation of foreign firms remains uncertain.

Industry analysts caution that Venezuela’s production outlook remains fragile. Storage capacity is still under strain, infrastructure challenges persist, and any prolonged delays in moving crude could disrupt output further. These risks complicate hopes of a smooth re-entry for international players eager to tap into Venezuela’s reserves.

Debate Grows Over US Strategy

Critics of the US approach argue that the policy risks inflaming geopolitical tensions and places heavy pressure on Caracas to open access to its oil resources. Supporters, however, frame the move as a practical step to stabilise energy flows and prevent further economic deterioration linked to stranded crude.

Online discussions reflect this divide. Commentators across platforms debate whether the move represents economic pragmatism or a deeper assertion of influence over a sovereign resource. The issue has reignited long-running questions about sanctions, control, and who ultimately benefits from Venezuela’s oil wealth.

Image 1: Graphic News

Why This Moment Matters

For Venezuela, oil has always been more than an export. It is the backbone of the economy and a powerful political lever on the world stage. With millions of barrels now moving under US oversight, the country’s energy future sits at a critical crossroads.

As 2026 unfolds, Venezuela’s oil sector is no longer just about production figures or market prices. It has become a symbol of how global power, politics, and energy security collide in an increasingly volatile world.

Follow Joburg ETC on Facebook, Twitter, TikT

For more News in Johannesburg, visit joburgetc.com

Source: IOL

Featured Image: PBS