Business

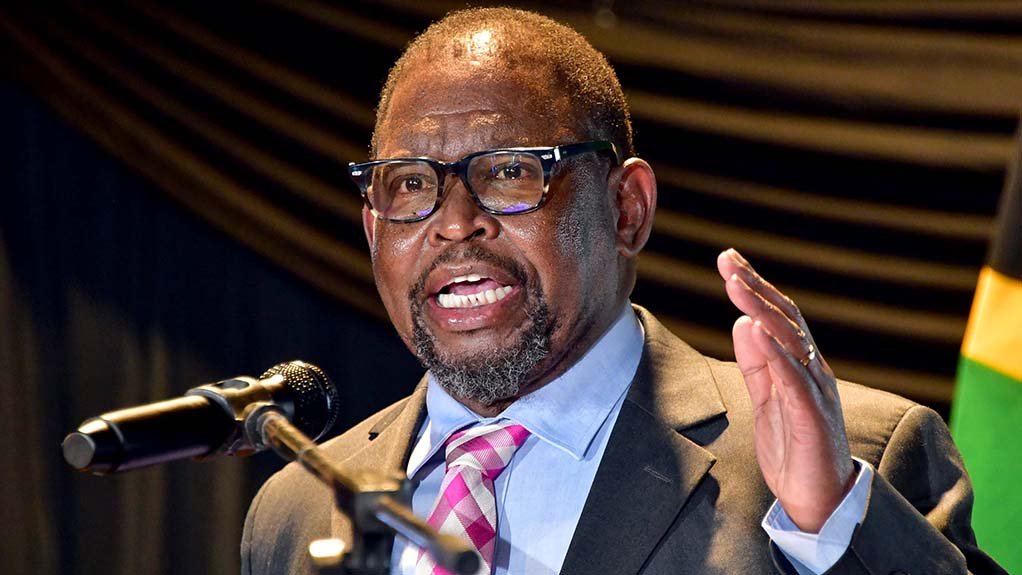

Godongwana offers cautious relief to South African taxpayers ahead of the budget

A rare moment of calm for taxpayers

After years of rising costs, bracket creep, and quiet tax increases that slowly ate into pay packets, South African taxpayers have been bracing themselves for more bad news. This week, however, Finance Minister Enoch Godongwana offered something close to relief.

Speaking from the World Economic Forum in Davos, Godongwana made it clear that the February budget is not expected to include any major or dramatic tax changes. While he stopped short of promising tax cuts, his message was simple enough. Treasury is not planning to rock the boat.

For households already stretched by food prices, fuel costs, and debt, that assurance alone landed as welcome news.

Why fiscal discipline still matters

Godongwana was careful not to oversell the moment. He stressed that keeping public finances under control remains critical, describing fiscal consolidation as essential groundwork for growth rather than a silver bullet.

In plain terms, Treasury wants to avoid spending more than it can afford, because without that discipline, other economic reforms struggle to gain traction. This stance has reassured investors and helped support the recent improvement in South Africa’s financial outlook.

Markets have responded positively. The rand has strengthened to its best levels against the dollar since 2022, bond yields have eased, and local equities are enjoying one of their strongest runs in years. That confidence has been boosted by healthier public finances, support for a lower inflation target at the Reserve Bank, and a credit rating upgrade from S&P Global Ratings.

The quiet pressure building at SARS

Behind the scenes, however, the tax picture is more complicated.

Godongwana’s softer tone comes after he warned in late 2025 that Treasury might need to find an extra R20 billion in tax revenue this year. Whether that happens now depends largely on the South African Revenue Service.

SARS has already reported better-than-expected collections, pulling in more than R18 billion above forecasts. Much of that came from higher corporate taxes, fuel levy increases, frozen tax brackets, and PAYE collected from Two Pot retirement withdrawals.

Yet there is a catch. Debt collection, which was meant to deliver a large portion of the extra revenue, is still underperforming. In the first half of the year, it fell about R700 million short of earlier expectations.

If SARS fails to meet its full collection targets, Treasury may still be forced to close the gap elsewhere.

Are new taxes completely off the table?

Not quite.

Godongwana said there would be no major or substantial tax changes, which leaves room for smaller, quieter measures. Economists point out that South Africans are already heavily taxed and arguably stretched beyond what the system can sustainably bear. Still, options remain on the table.

These could include another fuel levy increase or allowing inflation to push taxpayers into higher brackets once again. Neither would be labelled dramatic, but both would be felt quickly by households.

Trade talks and a fragile recovery

Adding another layer of complexity are ongoing negotiations with the United States. South Africa is still pushing for relief from a steep 30 percent tariff on its exports, the highest in sub-Saharan Africa. Godongwana has expressed confidence that a deal will be reached, although no timeline has been set.

For now, optimism is cautiously returning. Stronger markets, a firmer rand, and a budget that avoids major tax shocks would offer breathing room for consumers and businesses alike.

Whether that calm holds will depend on SARS, global trade talks, and how disciplined the Treasury remains when budget day finally arrives.

Follow Joburg ETC on Facebook, Twitter, TikT

For more News in Johannesburg, visit joburgetc.com

Source: Business Tech

Featured Image: Engineering News