News

Why China stayed on the sidelines as the US moved on Venezuela

When news broke of the January 2026 US military operation in Caracas, the shock travelled far beyond Venezuela’s borders. The mission, known as Operation Absolute Resolve, targeted sites in the capital and led to the capture of President Nicolás Maduro. For many watching from afar, one question surfaced almost immediately. If China had spent years building ties with Venezuela, why did Beijing not step in?

The answer sits at the crossroads of power, geography, and the quiet rules that shape how major nations test each other without tipping into open conflict.

Strong words, careful moves

Beijing reacted quickly after the intervention, but its response stayed firmly in the diplomatic lane. Chinese officials criticised the operation as a breach of sovereignty and urged respect for the United Nations Charter. The tone was sharp, yet the actions were restrained.

There were no threats of military retaliation. No promises of troops or defence support. Instead, China stuck to statements, opposition to unilateral sanctions, and practical measures such as advising its citizens to avoid travel to Venezuela.

Behind the scenes, the priority appeared to be protecting long-standing investments without provoking a direct showdown with Washington, especially in a region where American military power remains dominant.

A partnership built over decades

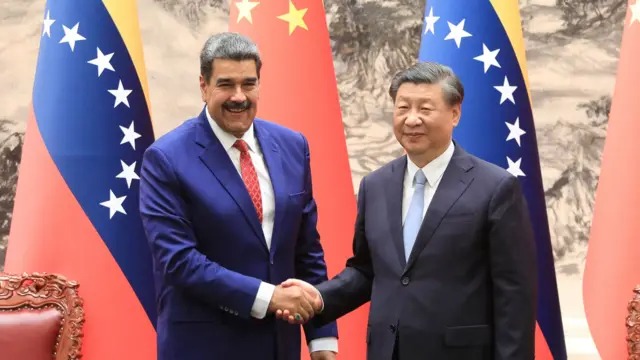

China’s connection with Venezuela was never symbolic. Over the past twenty years, the country has become one of Beijing’s most significant partners in the Americas. In 2023, the relationship was elevated to what China calls an all-weather strategic partnership, its highest level of bilateral status.

That label reflected deep cooperation across energy, finance, infrastructure, and political coordination. Chinese policy banks provided large financing packages, many tied to oil supply agreements that helped Caracas stay connected to global markets despite sanctions pressure.

Chinese companies were also active in major energy developments, including projects linked to the Orinoco Belt. Venezuelan heavy crude, while expensive to process, formed part of China’s broader strategy to diversify oil imports.

Security ties existed, too, but with clear limits. Venezuela purchased Chinese military equipment and hosted technical cooperation, such as satellite tracking support. What never materialised were formal defence guarantees, permanent troop deployments, or military bases. Those absences now look less like oversight and more like deliberate caution.

Why Beijing avoided a military response

The restraint reflects a long-standing pattern in China’s approach to Latin America. Beijing has invested heavily in trade, infrastructure, and finance but has consistently avoided direct military competition with the United States in the Western Hemisphere.

Operation Absolute Resolve exposed the reality behind that strategy. Economic influence does not translate into security control, especially in a region historically dominated by Washington’s military reach.

For China, escalating would have risked confrontation in a space where the balance of force is overwhelmingly tilted towards the US. From a strategic perspective, protecting economic interests without crossing that threshold became the safer option.

The oil equation just changed

The situation on the ground shifted dramatically after Maduro’s removal. The US gained significant influence over how Venezuela’s oil is sold and managed, shaping how revenue flows and under what terms crude reaches global buyers.

China is still able to purchase Venezuelan oil, but now at market rates and without the preferential arrangements that once strengthened Beijing’s leverage. That change hits two pressure points at once. It affects China’s long-term energy planning and complicates efforts to recover outstanding loans tied to earlier oil-backed deals.

With Washington influencing creditor negotiations, Beijing’s bargaining power in Caracas has been reduced. The partnership that once offered strategic advantage now comes with tighter conditions.

A bigger contest of worldviews

The episode also highlights a deeper contrast between how the US and China operate globally. Washington’s recent strategy places renewed emphasis on the Western Hemisphere as a core priority, signalling a determination to limit the presence of rival powers.

China’s model in Latin America has leaned on development finance, trade integration, and political cooperation rather than military projection. It aims to build influence through connectivity and long-term partnerships, positioning itself as a development partner rather than a security guarantor.

That approach still resonates with parts of Latin America that value autonomy and are wary of outside intervention. Yet the events in Venezuela show that when hard power enters the equation, economic relationships alone cannot hold the line.

Not a retreat, but a reset

Losing ground in Venezuela does not necessarily mean China is stepping back from the region. A more likely path is adaptation. Strengthening ties with larger economies such as Brazil and Mexico, while continuing investment and trade projects, offers alternative routes to maintain influence without direct confrontation.

On a broader level, the moment hints at an emerging world where informal spheres of influence are quietly recognised. Washington has reasserted dominance close to home. Beijing, in turn, continues to push for greater recognition of its strategic space in Asia.

The bigger picture

The Venezuelan crisis has become more than a regional flashpoint. It is a snapshot of how major powers test the edges of their reach in an increasingly multipolar system.

China’s decision not to intervene militarily was not simply hesitation. It was a calculated choice shaped by geography, risk, and the realities of competing with a rival that still holds overwhelming force in the Americas.

For observers around the world, the message is clear. Influence built through trade and infrastructure can travel far, but when hard power returns to the table, the old hierarchies still matter.

Follow Joburg ETC on Facebook, Twitter, TikT

For more News in Johannesburg, visit joburgetc.com

Source: IOL

Featured Image: BBC