Business

Januworry Check: Are Bank Fees Quietly Eating Into Your Money?

January has a way of shining an unforgiving spotlight on our finances. Festive spending is still echoing through our accounts, debit orders feel louder than usual, and every rand suddenly matters. In South Africa, this annual squeeze even has a name: Januworry.

For many households, the first instinct is to cut back on groceries, entertainment, or petrol. But there is one place people often overlook. Their bank account itself.

Monthly account fees, bundled services, penalty charges, and add-ons can quietly chip away at income, especially when those features are barely used. As the cost of living continues to bite, more South Africans are asking whether their bank is offering real value or simply convenience at a price.

What research has already flagged

Long before Januworry became part of everyday language, the Competition Commission of South Africa raised concerns about how banking fees work. Its Banking Market Inquiry, conducted between 2017 and 2019, found that retail banking pricing is often complex and difficult to compare. Fees tend to increase sharply as customers move up account tiers, while the practical benefits do not always rise at the same pace.

That finding still feels relevant today. Many account packages bundle multiple services together, which can leave customers paying for perks they never fully use.

The picture is reinforced by the FinScope Consumer South Africa survey from 2023. While most adults now have access to formal banking, many keep low balances and use only a fraction of what their accounts offer. Financial stress remains high, with households spending most of their income on essentials.

The real cost of common bank accounts

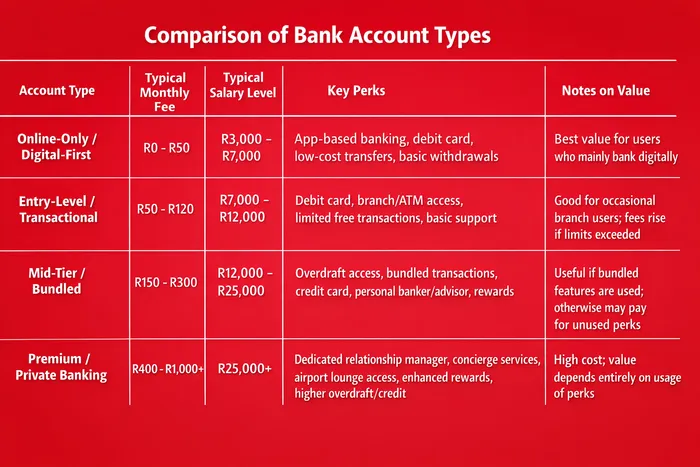

Not all bank accounts are created equal, and January is a good time to look closely at what you are paying versus what you actually need.

Digital-only accounts

These app-based accounts usually come with very low monthly fees, sometimes none at all. They focus on electronic transfers, card swipes, and mobile banking, with limited or no branch access. For people who rarely use cash or visit a branch, they often deliver strong value at minimal cost.

Entry-level transactional accounts

Sitting slightly higher on the ladder, these accounts offer basic branch and ATM access with a modest monthly fee. They work well for customers who occasionally need in-person services, but costs can rise quickly if transaction limits are exceeded.

Mid-tier bundled accounts

This is where Januworry often hides. Monthly fees climb, but so does the list of included features. Credit cards, overdrafts, loyalty rewards, and bundled transactions sound appealing, yet many users never fully tap into them. If the rewards go unused, the value equation starts to wobble.

Premium and private banking

Designed for high-income earners, these accounts promise personalised service, travel perks, and lifestyle benefits. They can make sense if those extras are actively used. If not, the monthly fee can easily outweigh the tangible gains.

Why January is the perfect time to question fees

Social media conversations every January tell the same story. People swap tips on cutting subscriptions, renegotiating insurance, and trimming food budgets. Bank fees are starting to feature more often in those discussions, especially as digital banking becomes more accessible.

The uncomfortable truth is that many South Africans upgrade accounts as their salaries grow, then never downgrade when their needs change. Others stay loyal to bundled packages out of habit, not because they still make financial sense.

Image 1: Business Report

A simple Januworry reality check

January does not require dramatic financial overhauls. Sometimes the biggest relief comes from small, deliberate changes. Asking a few honest questions can uncover easy savings.

Are you paying for services you rarely use?

Would a simpler or digital account match your daily banking habits better?

Are penalty fees or extra transactions quietly pushing up your costs?

Reviewing your bank fees alongside insurance policies, streaming subscriptions, and mobile contracts can free up money you did not realise was slipping away. In a tight month like January, that saving can feel surprisingly significant.

Follow Joburg ETC on Facebook, Twitter, TikT

For more News in Johannesburg, visit joburgetc.com

Source: IOL

Featured Image: iStock