Business

Kganyago Pushes for 3% Inflation Target Despite Treasury Pushback

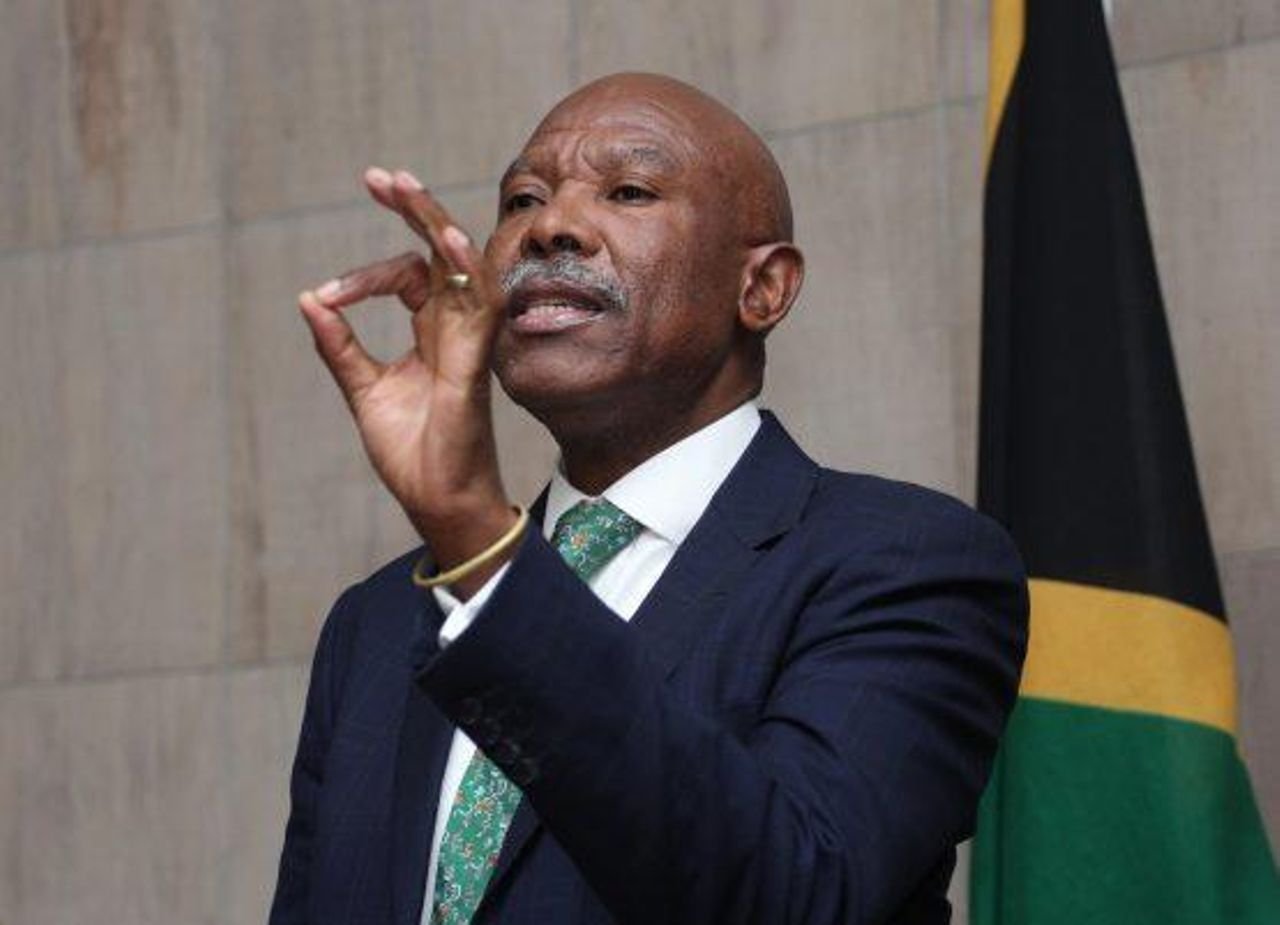

South Africa’s Reserve Bank Governor Lesetja Kganyago isn’t one to tiptoe around big policy calls and his latest stance is proof. Speaking this week, he doubled down on his controversial preference for a 3% inflation target, even though Finance Minister Enoch Godongwana hasn’t given it the green light.

Why 3% matters to Kganyago

Kganyago’s pitch is simple in theory but complex in politics: a lower inflation target, he argues, could make South Africa look less risky to investors, reduce the cost of borrowing, and bring more stability to prices.

“This cannot be a promise, but it can be a serious aspiration,” he said, noting that inflation has hovered near 3% for nine straight months a rare run he believes the country should seize on.

In the Reserve Bank’s math, today’s neutral policy rate sits at about 7.25%, of which 4.5 percentage points account for inflation and the rest for global rates and country risk. If inflation could be anchored at 3%, Kganyago says, that rate could drop to around 5.25%, easing pressure on households, businesses, and the government.

The clash with Treasury

The central bank’s public push for a 3% goal hasn’t gone down smoothly at National Treasury. Godongwana, who has been in ongoing technical discussions with SARB since early 2024, has yet to formally endorse the shift. The current 3%–6% target band has been in place for 25 years, and until now, SARB had unofficially favoured the midpoint.

For Treasury, lowering the target is not just a technical change, it’s a political and economic balancing act. While a firmer grip on inflation could reduce borrowing costs and help manage public debt (forecast to peak at 77.4% of GDP by 2026), there’s also the risk of tighter monetary policy stifling already fragile economic growth.

The moment to act or miss

For Kganyago, timing is everything. “Opportunity knocks, and over the past year that opportunity has come fast,” he said. With inflation already sitting at the lower edge of the current band, he believes this is the moment to lock in a more ambitious target, not watch it slip away.

Critics, however, warn that announcing such a move without Treasury’s sign-off risks looking like the Reserve Bank is setting policy unilaterally. Supporters counter that Kganyago is simply leading the conversation, and that South Africa’s credibility in global markets depends on a bold approach.

What’s at stake

If the 3% target were adopted and sustained, the potential payoff could be significant: lower interest rates, reduced inflation volatility, and cheaper debt servicing for the state. That, in turn, could help stabilise a debt trajectory that has been climbing for over a decade.

But for now, the proposal sits in limbo, caught between a central bank governor eager to move and a finance ministry wary of moving too quickly. Whether South Africa locks in this moment or lets it pass may shape the country’s economic path for years to come.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com