Business

Pressure mounts to raise South Africa’s R500,000 tax-free savings limit

When tax-free savings accounts were launched in March 2015, the goal was clear. Get South Africans to save more. In a country long criticised for its weak savings culture, the incentive was simple and attractive. Put money away and pay no tax on the interest, dividends, or capital gains.

A decade later, one of the country’s biggest financial services groups believes those limits are starting to feel outdated.

A decade on, but the lifetime cap stands still

Currently, South Africans can contribute up to R36,000 per year into a tax-free savings investment account. Over a lifetime, contributions are capped at R500,000. While the annual limit has gradually increased from R30,000 at launch to R33,000 in 2019 and then R36,000 in 2021, the lifetime cap has not moved since day one.

At today’s annual limit, a disciplined saver would hit the R500,000 ceiling in roughly 14 years. After that, no further contributions are allowed without facing penalties.

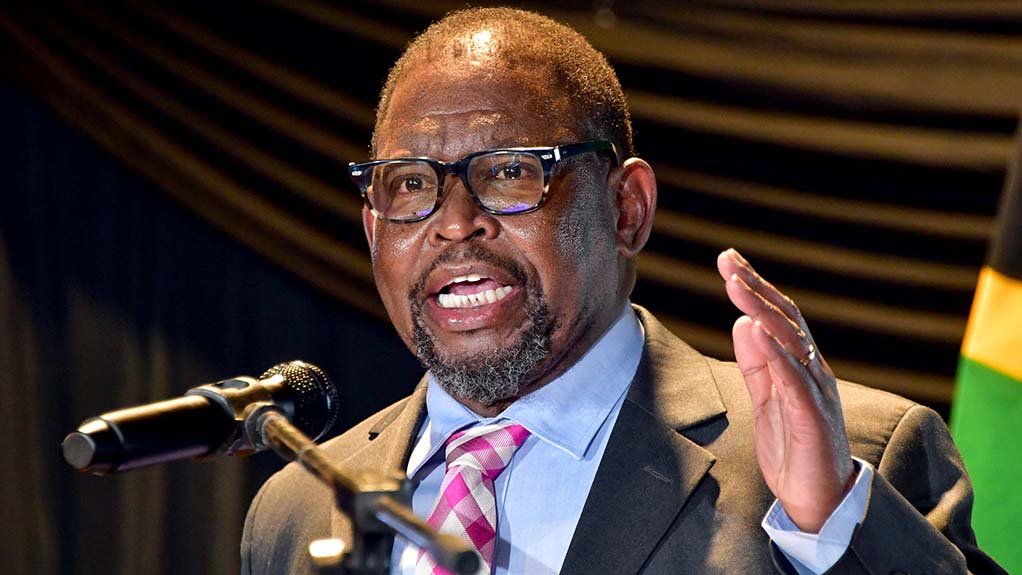

Old Mutual has now called on Finance Minister Enoch Godongwana to increase the lifetime cap to at least R600,000 and lift the annual contribution limit to R40,000. The proposal comes ahead of the upcoming National Budget.

Why Old Mutual wants change

According to Lizl Budhram, Head of Advice at Old Mutual Personal Finance, the intention behind tax-free accounts was sound, but the contribution limits no longer fully support that goal.

She argues that these accounts can play a meaningful role in strengthening retirement outcomes, especially when used alongside retirement funds and preservation vehicles. They offer tax-efficient growth and flexibility later in life, something many South Africans value as financial pressures mount.

An annual limit of R40,000, which works out to just over R3,300 per month, would still require discipline. However, it could significantly increase the long-term value of the tax-free benefit. Raising the lifetime cap to R600,000 would also extend the period during which savers can enjoy tax-free growth.

A bigger conversation about saving in South Africa

This proposal lands at a time when households are juggling rising living costs, high interest rates, and economic uncertainty. Social media conversations around budgeting and side hustles have become increasingly common, with many South Africans openly admitting that saving feels harder than ever.

Financial planners often point out that even small, consistent contributions can make a substantial difference over time, especially when growth is not eroded by tax. For younger professionals in particular, tax-free accounts are often pitched as a smart supplementary tool rather than a replacement for formal retirement funds.

Old Mutual’s view is that the limits should better reflect today’s economic realities and the original objective of encouraging long-term wealth creation.

The fine print savers must remember

While there are calls for higher caps, the current rules remain strict. Exceeding the annual contribution limit triggers a hefty 40 percent penalty tax on the excess amount. That is a costly mistake.

Importantly, investment growth inside the account does not count towards the contribution limit. If strong market performance pushes the account value above R500,000, that is not a problem. The issue arises when investors withdraw funds and then try to put the money back in. Any reinvested amount is treated as a new contribution.

Another detail that often catches people out is that the annual R36,000 limit applies across all tax-free savings accounts combined. Opening multiple accounts does not increase the cap.

What happens next?

With the National Budget around the corner, attention now turns to whether the government will respond to these calls. Any adjustment would signal a renewed push to improve household savings and retirement readiness.

For now, the debate highlights a bigger truth. In a country where financial resilience remains a challenge, every policy lever that encourages disciplined saving matters. Whether the cap moves to R600,000 or stays put, the message is the same. Tax-free growth is a powerful tool, but only if South Africans are able and motivated to use it.

Follow Joburg ETC on Facebook, Twitter, TikT

For more News in Johannesburg, visit joburgetc.com

Source: Business Tech

Featured Image: Polity.org.za