Business

SARB’s Repo Rate Cut Brings Much-Needed Relief to Struggling South Africans

When the cost of living climbs higher than your paycheck, even a small break can feel like a lifeline. This week, South Africa’s debt-laden households finally got some good news. The South African Reserve Bank (SARB) announced a 25 basis point cut to the repo rate, bringing it down to 7.25%.

For many workers who’ve been juggling groceries, rent, school fees and rising debt repayments, the cut feels like a much-needed breather. And while the move alone won’t solve the bigger economic puzzle, it signals hope in a time where hope is in short supply.

A Small Cut, A Big Message

It might not sound like much, but dropping the repo rate by 0.25% carries weight. The Monetary Policy Committee (MPC) believes this decision will help stimulate the sluggish economy, giving both consumers and businesses a reason to spend and invest.

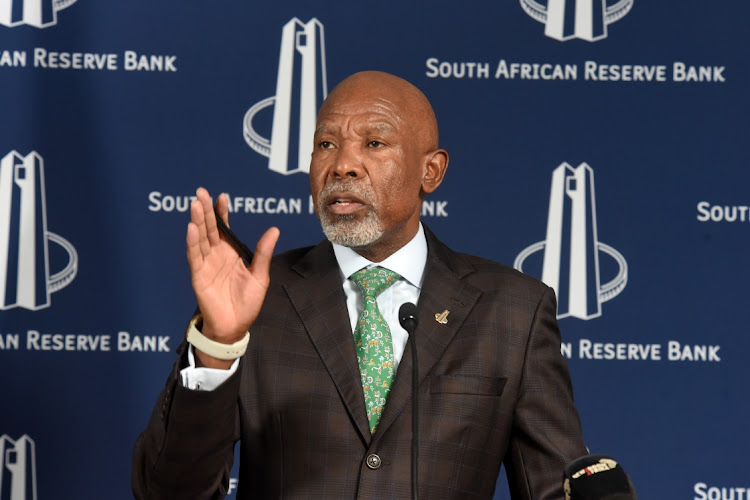

Governor Lesetja Kganyago explained the thinking behind the move, saying lower interest rates help restore confidence in the economy. “When people feel less squeezed financially, they’re more likely to spend, invest and get things moving again,” he noted during his briefing.

What’s more, the SARB is feeling slightly more upbeat about inflation. The Consumer Price Index (CPI), which measures the average price increase in everyday goods, is showing signs of calming down. If this trend continues and global conditions stay stable, the Reserve Bank might cut rates again later this year. That’s the kind of forward-looking optimism South Africans haven’t heard in a while.

Aiming for Lower Inflation, Long-Term Growth

Behind the scenes, SARB is also looking to shake up its inflation target range. The current range of 3% to 6% could soon be narrowed to a more focused target of 3%, with 4.5% as the medium-term goal.

This might sound like technical jargon, but here’s what it means in plain terms: if South Africa can keep inflation consistently low, it creates room for lower interest rates in the future. That’s a win for households trying to get out of debt and for small businesses trying to grow.

Aligning South Africa’s inflation strategy with that of other emerging markets could also attract investment and bring greater economic stability.

But There’s a Bigger Picture

While the rate cut is a step in the right direction, it doesn’t erase the economic challenges on the horizon.

The SARB also revised its growth forecasts for both the global economy and South Africa. Global growth expectations for 2025 and 2026 have been trimmed down from 3.1% to 2.5% and 2.9%, respectively. On the home front, South Africa’s own growth outlook has also been scaled back:

-

1.2% expected in 2025

-

1.5% in 2026

-

1.8% in 2027

Those aren’t the kind of numbers that make you pop champagne. In fact, slower growth often means fewer job opportunities and more strain on the average person.

South Africa already faces high unemployment and limited job creation, and these weaker forecasts won’t help. For a country where so many are already living paycheck to paycheck, any slowdown in economic momentum hits hard.

Finding Relief in a Tough Climate

For now, SARB’s rate cut is a welcome reprieve. It’s a signal that the central bank sees the everyday struggle and is taking action. It may not change everything overnight, but it’s a nudge in the right direction.

South Africans will need to stay sharp, manage their debt wisely, and hold on to any relief this cut provides. For businesses, it’s a prompt to invest carefully but optimistically. And for policymakers, it’s a reminder that sustained growth takes more than rate changes—it demands bold strategies to drive job creation and long-term development.

The Bottom Line

A lower repo rate won’t magically fix South Africa’s economic troubles, but it’s a meaningful step for workers under financial pressure. If inflation stays in check and the economy finds its feet, more cuts could follow, giving households the breathing space they desperately need.

Now is the time to tighten your financial strategy, stay informed, and make the most of the easing rate climate. The recovery may be slow, but with cautious optimism and collective effort, it’s within reach.

{Source: IOL}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com