Business

South Africa Expands Yuan Trade as Global Finance Shifts

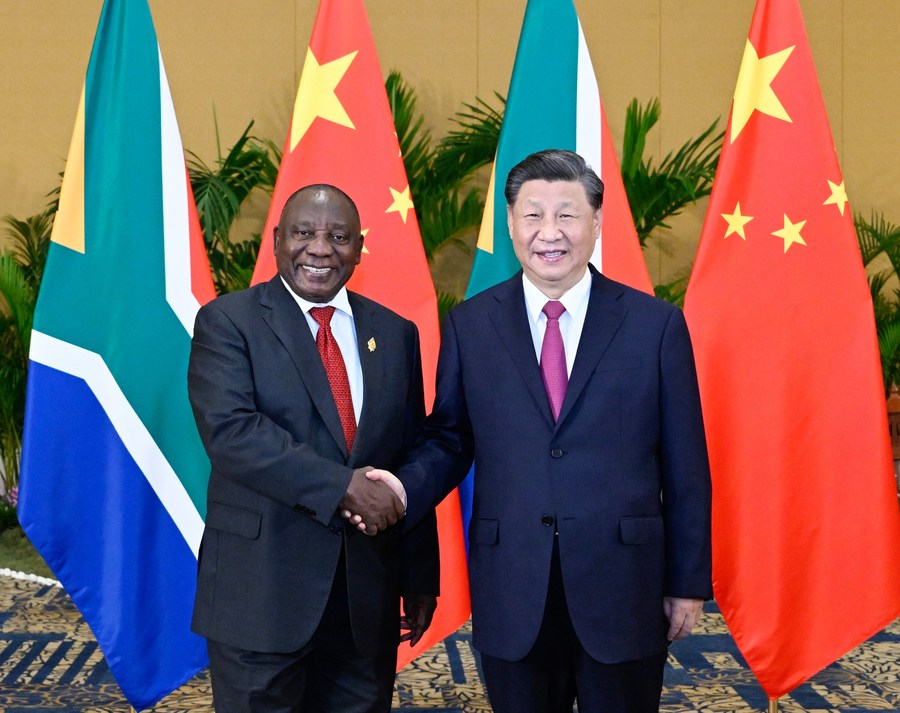

South Africa has taken an important step that signals a changing world order. The country is beginning to expand the settlement of some trade payments using the Chinese yuan instead of the US dollar. It is a move that many believe could influence how African economies engage with global finance.

A strategic shift driven by real concerns

The South African Reserve Bank recently enabled Standard Bank to process yuan transactions through CIPS, China’s international payment system. This means South African companies, as well as businesses in the Southern African Development Community, can now pay Chinese suppliers directly in yuan rather than converting through the dollar first.

This development arrives during a tense moment in global politics. Relations between Pretoria and Washington have cooled under US President Donald Trump, whose confrontational foreign policy has not gone unnoticed in South Africa. For those watching closely, the shift feels timely and practical.

Reducing reliance on Western-controlled finance

African nations have long raised concerns that Western-dominated financial systems create vulnerability. SWIFT, the global messaging network for banks, is often seen as ultimately influenced by political pressure from powerful governments. When Russia was partially removed from SWIFT during the Ukraine conflict, the world observed how quickly access to the system could become political.

Critics across the Global South say these decisions can hit weaker economies hardest. By making it easier to use yuan for trade with China, South Africa and neighbouring markets can reduce the risk of disruptions caused by foreign sanctions or geopolitical disputes.

Voices from the continent support the change

African traders, entrepreneurs, and online commentators have been vocal in support of the move. There is a growing belief that Africa should have more financial autonomy.

A Zimbabwean entrepreneur based in Johannesburg argued that Western powers have a history of using global banking systems to pressure noncompliant governments. A Nigerian trader echoed the sentiment, saying that diversifying payment systems is essential for protecting African economies.

Social media users have also shared praise for Pretoria’s decision. Many see it as a sign of confidence in African markets and a step toward greater independence in global trade.

What this means for South Africa and the region

Supporters say that increasing the use of the yuan could reduce reliance on the dollar for trade with China, protect payments from political interference, and broaden Africa’s financial relationships. South Africa already has strong economic links with China, and deepening those connections may support more regional trade and investment.

There is still a long road ahead. The US dollar remains dominant in most global markets, and change will be gradual. Yet many believe the world is entering a more multipolar financial era. By embracing the yuan for trade where it makes sense, South Africa is helping open new options for the continent.

The message is clear. Africa is positioning itself to shape its own financial future rather than relying on systems controlled elsewhere. This shift represents a growing desire for economic resilience and choice in a rapidly changing world.

Follow Joburg ETC on Facebook, Twitter, TikT

For more News in Johannesburg, visit joburgetc.com

Source: CAJ News Africa

Featured Image: www.idcpc.gov.cn