Business

Government Lifeline for Steel Industry Aims to Undo Years of Market Distortion

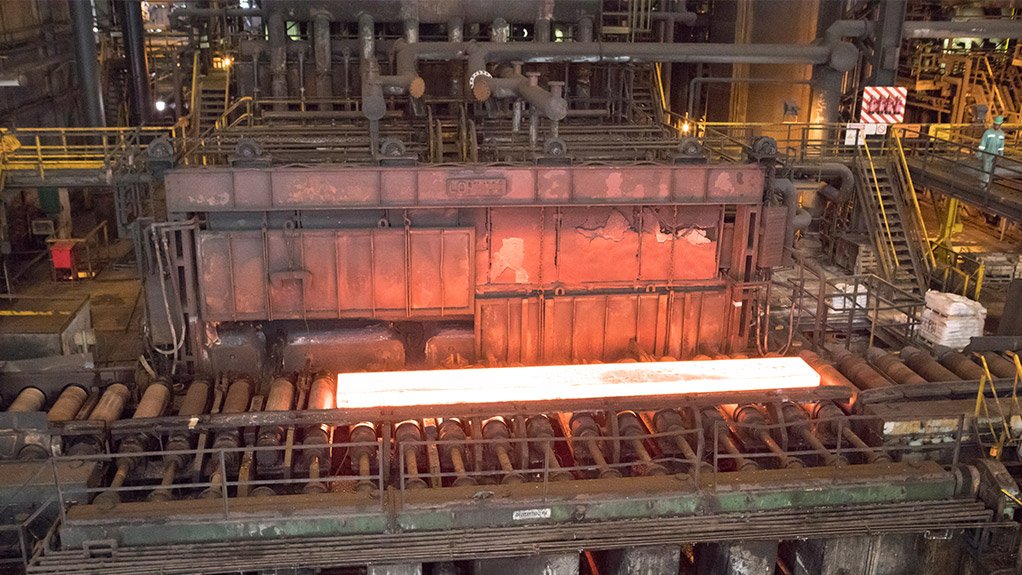

The future of a sustainable steel industry in South Africa hangs in the balance. After years of market distortions, policy missteps, and lopsided support, the government is stepping in to stabilise the sector—offering a glimmer of hope for long-term industrial growth, job creation, and the country’s decarbonisation goals.

South Africa’s steel sector is critical to infrastructure, industrial development, and green transition efforts. Yet, it’s been heavily skewed in favour of a small number of electric mini mill operators under the banner of the Electric Steel Producers Association (ESPA). These operators have benefited from a range of protections and subsidies, including:

-

Over R14 billion in Industrial Development Corporation (IDC) funding,

-

Scrap steel price preferences and export bans,

-

Tax holidays and energy discounts in special economic zones,

-

And an annual R5–6 billion scrap subsidy, effectively paid for by scrap collectors and downstream manufacturers.

Despite this substantial support, many ESPA members remain in financial distress, raising concerns about the efficiency and transparency of their operations. Unlike listed steel giants like ArcelorMittal South Africa (AMSA), these mini mills don’t publish detailed financials or sustainability reports.

Critics argue that ESPA’s dominance has come at the cost of broader industrial health. Thousands of informal scrap collectors have reportedly lost their income. The artificially low scrap prices have made it uneconomical to salvage and transport scrap, leading to underutilised resources in rural areas.

This imbalance became starkly apparent following AMSA’s decision to shut down its Longs Business—one of the last integrated steel producers in the country. The government, realising the systemic risk, has intervened to allow a deferral of this shutdown. This decision signals recognition that a more level playing field is essential to preserve South Africa’s steel capabilities.

At the heart of the issue is a flawed industrial policy that over-rewarded basic scrap-melting technology producing low-value rebar and billets, while starving higher-value producers of support. These billets are often exported, meaning South Africa uses precious electricity to create a semi-finished product, only for value-addition to occur overseas.

Without bold reform, South Africa risks becoming a low-margin exporter of basic steel while hollowing out its own manufacturing base.

Going forward, the industry requires:

-

Fair access to raw materials at competitive prices,

-

Equal treatment in tax and subsidy policies,

-

Incentives for local beneficiation and high-value steel production,

-

And greater transparency and accountability from all players.

Government intervention is not about picking winners, but about correcting structural imbalances that threaten the steel sector’s sustainability. If implemented wisely, it can reignite growth, protect jobs, and reposition South Africa as a competitive steel producer on the global stage.

{Source: IOL}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com