Business

Emerging Markets Steal the Show as Trump’s Tariffs Backfire

Donald Trump promised that tariffs would restore America’s manufacturing pride. Instead, they’ve shaken global markets and handed a surprising advantage to emerging economies, from China to South Africa.

A Gamble on Tariffs

When Trump rolled out tariffs earlier this year, Washington framed it as a fight for survival. The message was clear: foreign trade practices had become a “national emergency.” But as Sangeeth Sewnath of Ninety One put it at the Morningstar Investment Conference in Cape Town, tariffs are slippery things. “They serve two purposes,” he said. “Protection or leverage. Right now, it’s more leverage than protection.”

Economists warn that the US may soon face the worst of both worldsweak growth alongside higher prices. Grant Slade of Morningstar painted it bluntly: a “stagflation-style” scenario.

Behind all of this, Sewnath observed something cultural. Having spent a year working in the US, he described a mindset of preferring to be “strong and wrong” rather than “weak and right.” That instinct, he noted, runs deep in America’s exceptionalist DNA.

The Unintended Winners

Ironically, the big winners aren’t in Washington. They’re in Shanghai, Mumbai, and Johannesburg.

In China, Trump’s trade war has hardened the Communist Party’s grip on power and driven out Chinese scientists who once stayed in the US to build companies. Many of them have now returned home, fueling a fresh wave of innovation. “What Trump has done for China, China could not do for itself in decades,” said Liang Du of Prescient Private Fund Management.

India, meanwhile, is enjoying its own golden moment. Prime Minister Narendra Modi’s reforms, cheap labour, and a reputation for not being “part of the US-China rivalry” make it a hot alternative for global manufacturers. As one fund manager put it: “The other big advantage India has is simply that it isn’t China.”

Europe, by contrast, is trudging along, cushioned from supply shocks but weighed down by ageing populations, high taxes, and sluggish productivity.

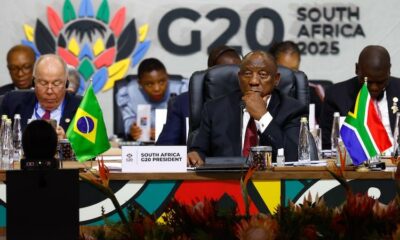

South Africa’s Mixed Fortunes

Here at home, South Africa hasn’t been left out of the story. Global fund managers are more bullish on emerging markets than at any point in the past two years, with local mining shares shining brightest. Gold and platinum group metals have surged, doubling their weight on the local index since January.

But beyond the resource boom, the picture is less glittering. Banks and retailers remain under pressure, and South Africa’s overall slice of the emerging-market pie continues to shrink. Commodities analyst Campbell Parry calls it a “fading star” compared to faster-growing peers. Still, many argue South African companies are survivorshardened by years of load shedding, corruption scandals, and pandemic shocks. Low expectations may now be their greatest strength.

How Investors Are Shifting

Local pension funds are adapting too. The Eskom Pension and Provident Fund has pushed offshore exposure to nearly half of its portfolio, while still backing unlisted South African ventures in tech and infrastructure. CIO Sonja Saunderson pointed out that Silicon Valley is eyeing some of these local innovations.

Globally, a weaker US dollar is expected to last well over a decade, providing tailwinds for emerging markets. Liang Du recommends keeping China in any diversified portfolio, while Sewnath warns investors not to fear volatility: “It’s a feature, not a bug. Build for the long term.”

A Turning Point in Global Power?

Since World War II, the US has dominated world trade. But 2025 feels different. Analysts are calling this moment a turning point, where the weight of global growth shifts east and south. For many in South Africa, it’s a reminder that while the US may be rewriting trade rules, the real story is unfolding in the world’s emerging markets.

{Source: Daily Maverick}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com