News

Godongwana’s Make-Or-Break Budget: No VAT Hike, But Expect Other Tax Surprises

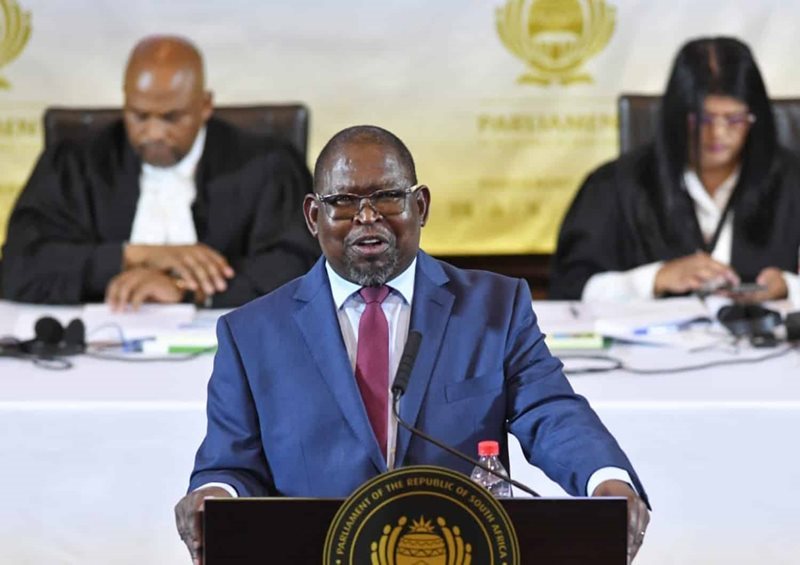

Finance Minister Enoch Godongwana is set to deliver a high-stakes 2025 Budget Speech at 2 PM today—his third attempt to secure parliamentary approval after two failed tries.

This version finally ditches the controversial VAT hike, a move that drew heavy criticism from opposition parties and civil society. Treasury confirmed this morning that VAT will remain at 15%, following a court-backed settlement with the Democratic Alliance (DA) that overturned earlier budget proceedings.

Watch It Live

The speech will be broadcast live from the Cape Town International Convention Centre via:

-

eNCA

-

SABC

-

Parliament TV

-

Parliament’s YouTube Channel

-

Government’s official Facebook and X (formerly Twitter) accounts

The Budget has been a flashpoint in South Africa’s fragile Government of National Unity (GNU), with the African National Congress (ANC) and DA clashing over how to plug a growing fiscal deficit.

The original proposal to increase VAT to 17% never made it to the floor. A watered-down version with a phased increase also failed to gain DA support, prompting the ANC to push it through with the help of smaller opposition parties. However, following legal and procedural challenges, Treasury had to start from scratch.

Today’s Budget is expected to win broad support in Parliament, as it aligns with the GNU’s revised fiscal roadmap.

No VAT Hike—But It’s Not All Good News

While the VAT hike is off the table, Treasury is still under immense pressure to raise revenue. Expect announcements on:

-

Fuel Levy Increases: The first in three years, potentially adding R4 billion to state coffers.

-

Excise Tax Hikes: On alcohol and tobacco, estimated to bring in R1 billion.

-

Stealth Taxes: Treasury may keep income tax brackets unchanged, leading to ‘bracket creep’, which could raise R19.5 billion.

-

Medical Aid Credits Freeze: No adjustments expected, further boosting revenue.

According to economists, these measures are the least politically explosive ways to address the deficit without spooking markets.

Debt and Cuts: The Balancing Act

Treasury also hinted at major spending cuts and tight borrowing strategies, aimed at stabilizing national debt.

Investec Chief Economist Annabel Bishop cautioned that increased borrowing is unlikely to be a preferred solution.

“Cutting expenditure is a prudent solution as South Africa is battling to fund its fiscal deficit and needs to consolidate its finances to improve fiscal sustainability,” Bishop said.

With the VAT battle behind him, Godongwana is expected to pivot toward a more politically palatable blend of tax tweaks and spending cuts. Today’s Budget Speech will set the tone for South Africa’s economic direction heading into a challenging fiscal year.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com