News

Businessman Loses R8.5m to Fake Lawyer Friend | SCA Rules on Fidelity Fund Claim

A Golf Buddy, a Fake Lawyer, and R8.5 Million Gone: The Cost of Trust

It’s a story that reads like a Hollywood thriller, set against the manicured lawns of Johannesburg’s Houghton Golf Club. A friendship forged on the fairway led to a devastating betrayal, a phantom lawyer, and a loss of over R8.5 million. Now, after a years-long legal battle, the Supreme Court of Appeal has delivered a final, painful verdict to businessman Ian Julian Smith.

The Man Who Never Was

It all began in 2012. That’s where Smith met Andruw Stephens, a seemingly successful attorney from Dadic Attorneys. Their friendship grew, built on a shared interest and a foundation of trust. When the firm’s principal emigrated to Australia in 2015, Stephens was left in charge, solidifying Smith’s confidence in him.

The first transaction seemed legitimate. Smith won a legal case against a UK company, and the R900,000 payout was deposited into Dadic’s trust account. But it never reached Smith. This was the first thread that would later unravel a massive deception.

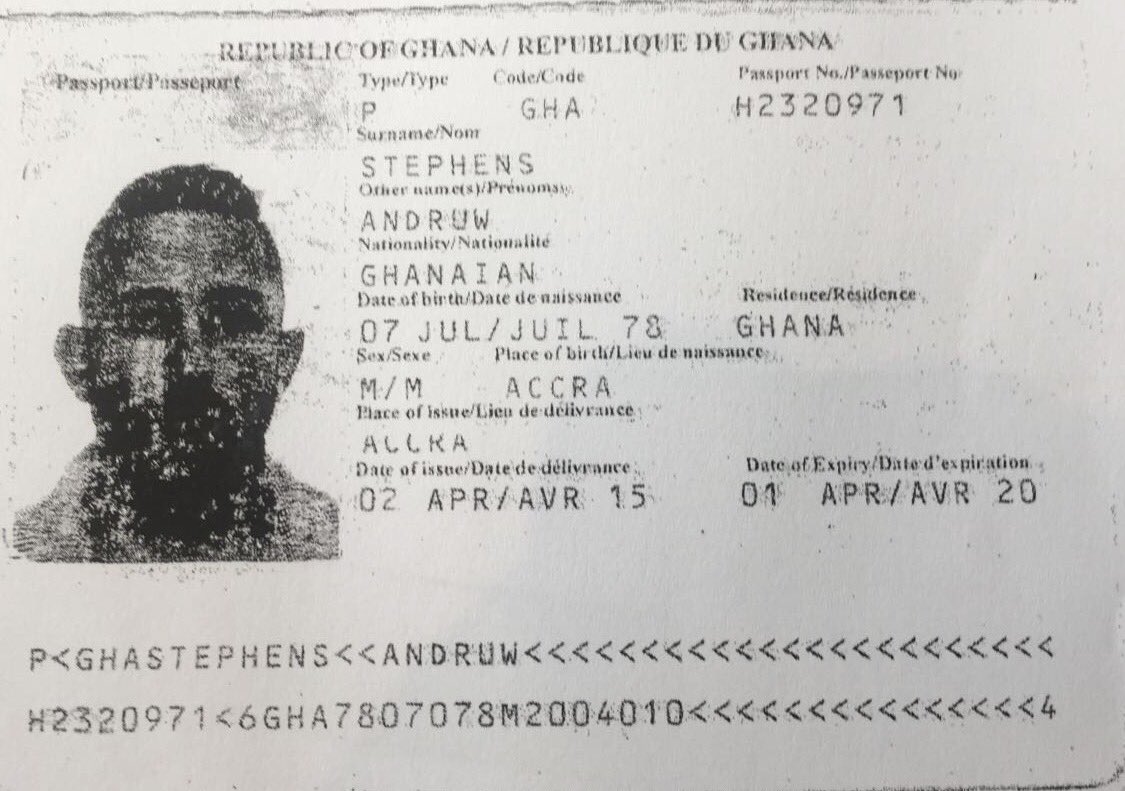

Stephens, it turned out, was not an attorney at all. He was the firm’s financial officer. And his name wasn’t even Andruw Stephens; his real identity is Andrew Steven Rapport, who would later flee the country using a fraudulent Ghanaian passport.

The Web of Lies

What followed was a classic Ponzi scheme, tailored with legal jargon. Stephens spun tales of lucrative, time-sensitive deals: bridging finance for a company called Flake Ice, purchasing a client’s debt at a discount, acquiring a massive “book debt.”

He promised irresistible returnsfive percent monthly interest, huge payouts within months. To build credibility, Stephens even paid Smith back with his own money for the first “investment,” creating the illusion of success. Smith received R1.3 million in “returns,” hooking him deeper into the scam. Over three years, he deposited over R8.5 million into the law firm’s trust account, believing it was safe.

The facade shattered during a golf tour in Durban in 2018. A call from a real attorney at Dadic, Trevor Swartz, delivered the news: Stephens had checked into a psychiatric facility and vanished. The trust accounts were empty. Every deal was fictitious.

The Long Fight for Justice

With the conman reportedly living as a fugitive in the United States under various aliases, Smith turned to the Legal Practitioners’ Fidelity Funda safety net designed to reimburse clients who suffer theft by their attorneys.

His claim was rejected. The Fidelity Fund argued Smith wasn’t a client who had “entrusted” money for legal services; he was an investor who had chosen to participate in speculative business deals, even if they were fake.

Smith fought the decision all the way to the Supreme Court of Appeal. The court’s ruling was a mixed and nuanced bag of justice. Acting Judge Gerald Bloem ruled that the initial R900,000 from the UK lawsuit was indeed entrusted money, entitling Smith to reimbursement from the fund.

However, for the remaining R8.5 million, the court agreed with the Fidelity Fund. The judges found that Smith had transferred the money not for legal services, but to participate in Stephens’ proposed investments. The fact that the money briefly passed through a law firm’s trust account did not change its nature as an investment, however fraudulent.

The ruling highlights a critical distinction in law: the Fidelity Fund is not an insurance policy against bad investments, even those orchestrated by a lawyer. It is a protector of client funds held for legitimate legal purposes.

For Ian Smith, the verdict is a costly lesson in the difference between trust and entrustment. It’s a reminder that even in the most respectable settings, the promise of high returns can obscure the most elaborate deceptions.

{Source: IOL}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com