News

Court Seizes R4 Million in Diamond Dealer Louis Liebenberg’s Alleged Ponzi Scheme

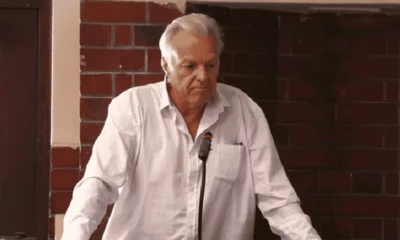

The shine has worn off South Africa’s most controversial diamond dealer. This week, the Pretoria High Court delivered a decisive blow to Louis Liebenberg and his business empire, ordering the forfeiture of R4 million allegedly tied to a fraudulent investment scheme.

The ruling follows an application by the National Prosecuting Authority’s Asset Forfeiture Unit (AFU), which invoked Section 48 of the Prevention of Organised Crime Act. The seized funds, previously parked in a Standard Bank account under ZencoCare (Pty) Ltd, will now flow into the Criminal Assets Recovery Account (CARA) the state’s war chest for tackling organised crime.

A Glittering Promise That Never Existed

Liebenberg, often dubbed “the diamond king” by his followers, has been a polarising figure in South Africa’s investment landscape. Through his Forever Diamonds and Gold group, he sold everyday South Africans and foreign investors the dream of striking it rich on diamond parcels, promising lucrative short-term returns.

But as investigators discovered, those parcels were nothing more than smoke and mirrors. Instead, money from new investors was allegedly used to pay old ones, a hallmark of a Ponzi-style scheme that has left many victims out of pocket.

Even more entangled in this saga is ZencoCare, a company registered in the name of Liebenberg’s wife, Desiree. The NPA claims she played a central role in the network of companies that facilitated the alleged fraud.

Where the Money Was Headed

In 2024, ZencoCare transferred R5 million to attorneys, with R1 million supposedly earmarked for Eskom-linked mining activities. The remaining R4 million, which has now been seized, was initially meant to fund the acquisition of West Coast Resources, a Northern Cape diamond mine.

Instead, it will be redirected to the state. For many who lost their life savings to this alleged scheme, the move is seen as symbolic justice. though it does little to restore their personal losses.

The Bigger Picture

South Africans are no strangers to flashy investment pitches that end in tears. From pyramid schemes to forex scams, the hunger for quick returns has left a trail of broken promises. What makes the Liebenberg case striking is not just the money involved, but the reach: both local and international investors were targeted.

On social media, reactions to the forfeiture order have ranged from relief to outright anger. Some victims say the state’s move comes “too little, too late,” while others see it as a long-overdue clampdown on white-collar crime.

What’s Next for the Liebenbergs?

The NPA confirmed that both Louis and Desiree Liebenberg remain in custody, alongside seven co-accused who face charges of fraud, racketeering, theft, and money laundering. Their next court date is set for November 25 at the Bronkhorstspruit Magistrates’ Court.

While the R4 million seizure is significant, it’s just one piece of a larger legal puzzle. For now, it sends a clear signal: South Africa’s justice system is tightening the noose around financial crime, ensuring that even the most glittering scams lose their shine.

{Source: IOL}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com