News

A Chilling Forecast: Hopes for Interest Rate Cuts in South Africa Suffer a Major Blow

For millions of South Africans straining under the weight of high car and home loan repayments, the light at the end of the tunnel has just dimmed. The widespread hope for imminent interest rate cuts has been dealt a major blow, with economists and markets now pushing their forecasts for financial relief further into the future.

The anticipated turning point in the cost of borrowing, which many had pinned their budgets on, is now receding. The reason is a stubborn economic reality that is forcing the South African Reserve Bank to maintain its tough stance.

The Stubborn Hurdle: Persistent Inflation

The primary roadblock to rate cuts remains inflation. While the headline consumer price index may have cooled from its peak, the core components that the SARB watches most closely remain stubbornly high. Key drivers like food prices, service costs, and administered prices like electricity and water are proving difficult to tame.

The Reserve Bank’s mandate is to anchor inflation firmly within its 3% to 6% target range. Until it is confident that price pressures are sustainably under control, it cannot risk cutting rates. A premature cut could unleash another wave of inflation, undoing all the painful work of the last two years of hiking cycles.

Global Winds Working Against South Africa

The local picture is further complicated by the international scene. Major central banks, like the US Federal Reserve, are also in a holding pattern, keeping their rates high to combat their own inflation battles. When these key banks maintain high rates, it puts pressure on emerging markets like South Africa to do the same to prevent capital outflows and a sharp depreciation of the Rand.

A weaker Rand would, in turn, make imports more expensive, fueling the very inflation the SARB is trying to fight. It’s a delicate balancing act, and for now, the priority is stability over stimulus.

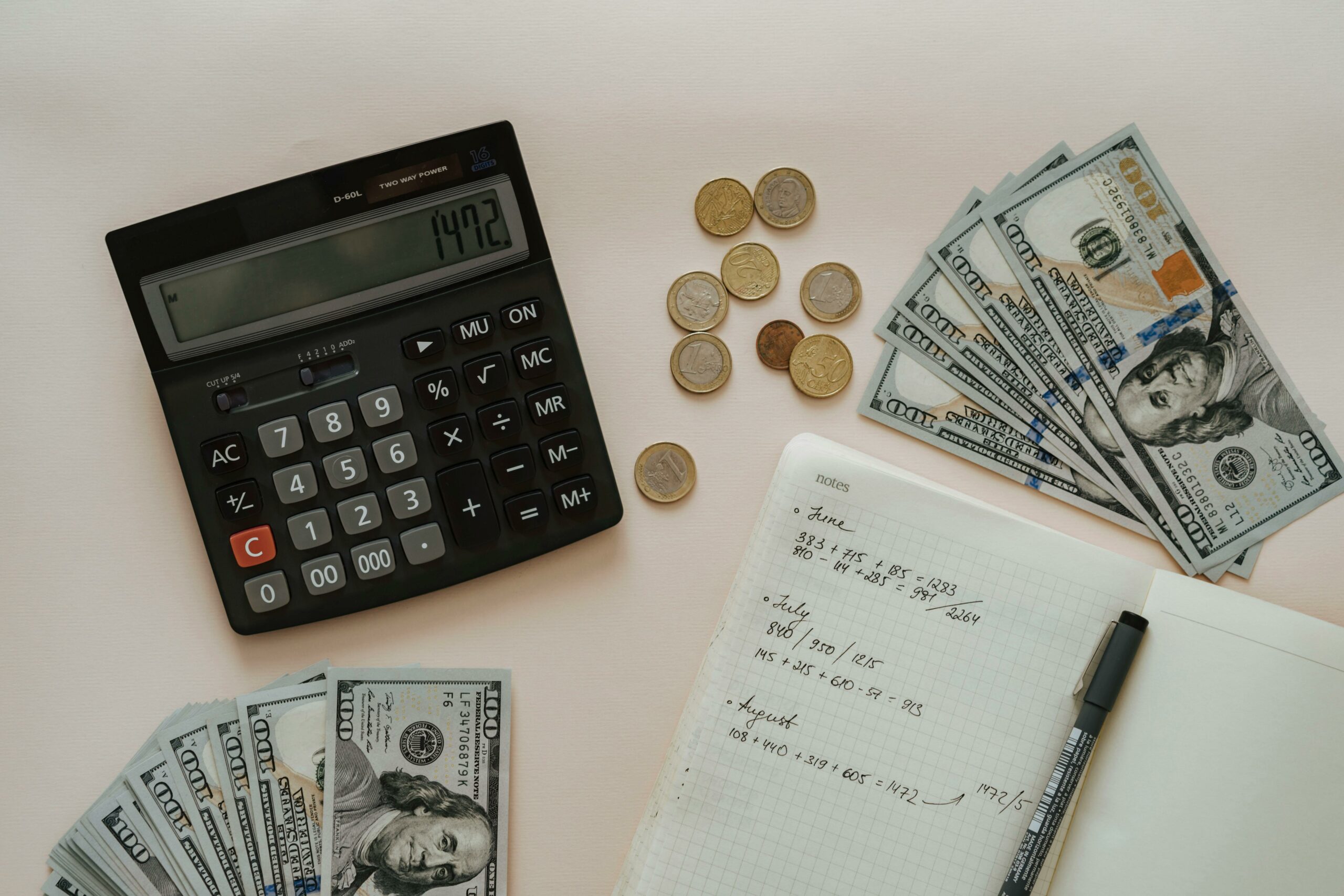

What This Means for Your Wallet

The practical implication of this delay is simple: the financial pressure on households and businesses is set to continue. The high cost of servicing debt will remain a heavy monthly burden, leaving less disposable income for other expenses and dampening economic growth.

The timeline for the first cut is now being pushed from early 2025 to later in the year, with some analysts even warning of a possibility of no cuts at all if the data does not improve. For now, the message from the markets is clear: buckle up. The wait for financial relief is going to be longer and more uncertain than many had hoped.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com