News

Billions Flow into South Africa as Meta and Microsoft Bet Big on Energy and AI Infrastructure

Private sector is steering a surprising investment revival in 2025, led by global tech players and clean energy pioneers.

In a year marked by economic hesitations and public sector paralysis, two unlikely heroes have emerged in South Africa’s investment story: Silicon Valley and renewable energy.

While Nedbank’s Capital Expenditure report paints a sobering picture of national investment trends for the first half of 2025, there’s a twist, tech giants like Meta and Microsoft are doubling down on South Africa, pouring billions into next-gen infrastructure, even as government-backed projects grind to a near halt.

Public Investment Collapses, Private Sector Steps In

The numbers are stark. According to Nedbank, the value of newly announced investment projects plummeted to R316.2 billion in the first half of 2025, a dramatic fall from last year’s R592.2 billion. And here’s the kicker: not a single new project was announced by the public sector.

That’s a sharp U-turn from 2024, when public investment accounted for 83% of all projects.

This time, the private sector is carrying the entire load, and some of the biggest bets are being made by the usual suspects in global tech.

Meta’s Massive Subsea Play: Project Waterworth

The standout is Meta, the parent company of Facebook and Instagram, which is spearheading Project Waterworth, a R20 billion initiative that makes up 75% of the total investment in the transport and communications sector.

The project’s aim? A global subsea cable system connecting South Africa with the US, India, Brazil and more, laying the groundwork for faster internet and robust AI support infrastructure across the Southern Hemisphere.

In local tech circles, the buzz is real. “This is not just about cables,” said Cape Town-based data scientist Thando Mthembu. “It’s about plugging South Africa into the AI economy and doing it with real infrastructure.”

Microsoft Expands Its African Cloud

Not to be outdone, Microsoft is sinking R5.4 billion into expanding its cloud and AI infrastructure footprint in South Africa, a signal that the global AI race has squarely reached African shores.

This investment aligns with the company’s broader mission to establish South Africa as a regional data hub, capable of serving not just domestic demand, but also supporting satellite operations across sub-Saharan Africa.

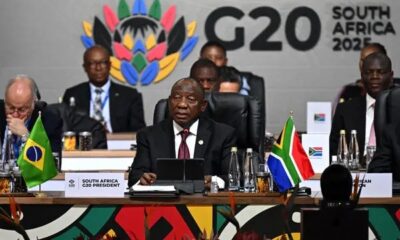

President Cyril Ramaphosa even appeared alongside Microsoft President Brad Smith at a recent Johannesburg tech roundtable, calling the investment “a show of faith in our future.”

Energy: Where the Real Money Is Going

But it’s not just tech. Energy is commanding the lion’s share of attention, 63% of all private investment projects in the first half of 2025 are energy-related.

Topping the list is Earth & Wire’s R40 billion “Energy Fields” project, an ambitious blend of 700MW of wind power, 800MW of solar, and up to 500MW of battery storage. It’s being hailed as one of the most advanced independent energy projects ever launched in the country.

Other renewable ventures include the Overberg Wind Farm (R13 billion), Photon Energy’s concentrated solar with thermal hydrostorage (R11.5 billion), and a long list of PV, battery, and wind developments aiming to help end the country’s dependency on coal.

“These projects are not just about clean energy,” said an energy analyst in the Western Cape. “They’re about creating a resilient power grid that allows the economy to grow and investors clearly get that.”

Cultural Impact and Social Buzz

Online, the response has been mixed, but mostly hopeful. On LinkedIn and X, South African tech entrepreneurs are calling this “the beginning of a new era” and “a shift from complaint to capacity.”

There’s also growing pride in seeing global companies choose South Africa despite global economic headwinds, and despite well-known challenges like load shedding, grid bottlenecks, and logistical red tape.

Why This Matters More Than It Seems

For a country still bruised by power shortages, policy paralysis and underwhelming public sector leadership, this wave of private-led investment is more than just a silver lining, it’s a potential turning point.

But as Nedbank warns, not all is smooth sailing. Grid capacity constraints are already starting to bite, and without major upgrades to national transmission infrastructure, many of these clean energy dreams could remain stuck in the approval pipeline.

Nedbank also flagged other concerns: elevated public debt, sluggish reform delivery, and the ripple effects of international tariff wars, particularly those recently sparked by the US.

Public Sector Must Step Up

There’s optimism, but it’s cautious. While a modest investment recovery is expected later in the year, helped by interest rate cuts and pent-up private demand, the real shift will only happen if government starts pulling its weight again.

Until then, the private sector, it seems, will be the one keeping the lights and servers on.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com