News

MTN’s South African Struggles: Growth Stalls in a Tough Market

Competitive pressure, weak economic growth, and a bank-heavy fintech sector leave MTN SA treading water

In a market as mature and saturated as South Africa’s telecom sector, standing still can feel a lot like falling behind. That’s the dilemma MTN South Africa is facing, as its growth trajectory flattens despite being a key pillar of the MTN Group’s broader African strategy.

MTN may be Africa’s mobile giant, but here at home, the yellow brand is struggling to shine.

Growth is Holding, But Barely

According to MTN’s Q1 2025 results, South Africa remains one of its top four markets alongside Nigeria, Ghana, and Uganda. But the local numbers tell a story of stagnation. Quarterly revenue dropped to R12.56 billion — a 3.1% decline from the same period last year and earnings before interest, taxes, depreciation, and amortisation (EBITDA) also dipped by 2.6%.

Service revenue nudged up a modest 2.6% year-on-year, largely due to a nearly 4% increase in data revenue. Yet with inflation hovering above 5%, that growth barely registers in real terms.

“It’s not like MTN South Africa is shrinking, it’s just not growing,” said Roy Mutooni, a portfolio manager at Sanlam Investments, speaking on Business Day TV. “It’s where competition is the most intense.”

And he’s right. With Vodacom’s entrenched dominance and Telkom clawing market share through aggressive pricing and bundling, MTN is caught in a price-sensitive tug-of-war, particularly in the prepaid market.

Prepaid Takes a Hit While Postpaid Gains

The pinch is sharpest in MTN’s prepaid business. While total subscriber numbers were up year-on-year to 39.2 million (a 5.6% increase), they dipped from 39.8 million just last quarter. Prepaid customers now sit at 29.1 million, and the company admits that competitive pressure here remains high.

In response, MTN adjusted prepaid tariffs in April, following similar changes to postpaid plans in February, and rolled out more regionalised, personalised offers. It’s a strategic shift aimed at clawing back value in a tough economic environment.

On the bright side, postpaid subscribers rose 6.7%, reaching 4.4 million. MTN attributes this growth to greater uptake of voice-data bundles and home connectivity packages, a rare win in an otherwise lukewarm market.

Fintech Fumbles in a Bank-Dominated Economy

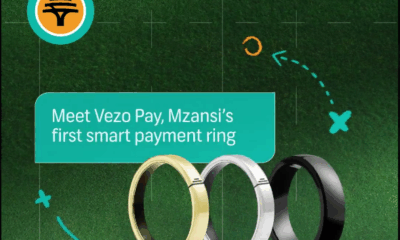

If there’s one bet MTN is hoping pays off, it’s fintech, particularly MoMo, its mobile money platform. But South Africa may not be fertile ground for that vision.

“Most South Africans are already banked,” Mutooni explained. “It’s difficult to introduce alternative payment platforms when the banks have already saturated the market.”

This isn’t MTN’s first shot, nor the industry’s. Vodacom tried to launch M-Pesa locally years ago, only for it to flop. While MTN is pushing MoMo hard, and making some progress, the South African fintech landscape is miles away from the runaway success seen in Kenya or Uganda.

Still, MTN and Vodacom continue to invest in their non-cellular businesses. Higher returns make fintech appealing — even if the path to dominance is unclear.

Outside South Africa: A Rosier Picture

Fortunately for MTN Group, its fortunes don’t hinge solely on the South African market. Around 80% of its earnings come from just four countries, Nigeria, Ghana, Uganda, and South Africa and the growth outlook is far stronger elsewhere.

“Nigeria looks like a business nicely positioned for medium-term growth,” Mutooni noted. The country recently completed regulatory adjustments that now allow for price increases, and MTN is the top operator there.

Ghana, where MTN dominates voice and data with up to 80% market share, continues to post solid results. Uganda, though smaller, remains consistent, especially with mobile money fueling revenue growth.

Currency volatility, a longtime pain point in African markets, may also be stabilising. According to Mutooni, recent devaluations across the continent have “reset currencies to more reasonable levels,” offering some relief from macroeconomic shocks.

A South African Story in a Pan-African Company

The irony? MTN is more African than South African in both performance and potential. While the local market battles saturation, weak GDP growth, and fierce rivals, MTN’s real growth narrative is playing out across the continent.

Back home, however, the pressure is on. With inflation expected to moderate and interest rates likely to ease in 2025, consumer health may improve. But that won’t change the fact that MTN needs to fight harder and smarter, to stay relevant in its own backyard.

The question is whether that fight will pay off, or if MTN will continue to trail its competitors in the market it once helped define.

{Source: My Broad Band}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com