City Updates

Gauteng’s unpaid bills problem is spiralling and ordinary residents may pay the price

Gauteng’s unpaid bills problem is spiralling and ordinary residents may pay the price

It’s becoming harder to ignore the warning signs flashing across Gauteng’s cities. From rolling service interruptions to stalled infrastructure upgrades, the province’s three biggest metros are under growing financial strain and the numbers behind it are staggering.

Johannesburg, Tshwane and Ekurhuleni are sitting with billions in unpaid municipal bills, pushing Gauteng’s overall municipal debt to alarming levels. What’s fuelling fresh outrage, however, is not just how big the debt has become, but who hasn’t been paying.

A debt crisis years in the making

Gauteng’s ballooning municipal debt didn’t appear overnight. It’s the result of years of broken billing systems, weak financial controls, political instability and an entrenched culture of non-payment that has spread from households to the very officials tasked with enforcing the rules.

According to figures revealed by Gauteng MEC for finance and economic development Lebogang Maile, municipalities across the province are owed an estimated R167 billion. Within that figure is a particularly uncomfortable detail: municipal officials and councillors themselves owe R165.7 million in unpaid rates, taxes and service charges.

In a province where residents are frequently told they must pay to keep services running, the revelation has landed badly.

Joburg, Tshwane and Ekurhuleni lead the list

Among government employees in arrears, Johannesburg tops the list, with officials owing R74.8 million. Tshwane follows at R36.2 million, while Ekurhuleni officials owe R22.9 million.

While households and businesses still account for the bulk of municipal debt largely linked to electricity, water and property rates the presence of public officials among defaulters has sharpened criticism around leadership and accountability.

For many residents, the optics are simple: if those in power aren’t paying, why should anyone else?

Silence after the bombshell

The anger has only grown because of what happened next. After making the figures public, Maile’s office largely stepped back from further engagement, referring questions to municipalities and the Department of Cooperative Governance and Traditional Affairs (Cogta).

His spokesperson, Onwabile Lubhelwana, said the MEC had “merely made a report public” and pointed to existing treasury controls, including compliance with the Municipal Finance Management Act. Questions about enforcement, consequences or timelines were left unanswered.

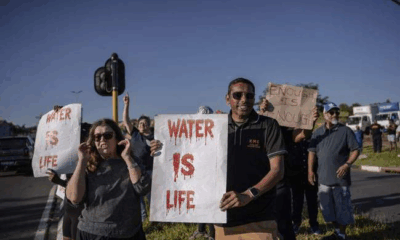

On social media, frustration was immediate. Residents questioned how a crisis of this scale could be disclosed without a clear plan of action or even a public commitment to recover the money.

‘Unacceptable’ leadership failure

Civil society groups have been blunt. Organisation Undoing Tax Abuse (Outa) CEO Wayne Duvenage described the situation as a clear governance failure, arguing that the problem is not technical but political.

According to Duvenage, inaccurate billing, weak debt management systems and a lack of political will have allowed the crisis to deepen. In his view, any private business operating this way would have collapsed long ago.

Household debt, he added, is often driven by incorrect accounts and dysfunctional systems issues that undermine public trust and discourage compliance.

Opposition parties pile on pressure

The Democratic Alliance in Gauteng has echoed these concerns, with finance spokesperson Ruhan Robinson saying weak credit controls and poor accountability allowed the debt to spiral.

Robinson criticised political leaders for condemning a “culture of non-payment” while officials themselves remain in arrears. He argued that municipalities should immediately enforce repayment agreements and require defaulting councillors and officials to formally acknowledge their debt.

“Leaders need to lead by example,” he said a sentiment widely shared across Gauteng’s ratepayer groups.

Soweto’s unpaid bills deepen trust crisis

The Forum for South Africa (Fosa) has also raised the alarm, particularly around reports that Soweto residents owe nearly R5 billion in unpaid municipal and electricity bills.

Fosa leader Tebogo Mashilompane said the disclosure that councillors and officials are also behind on payments risks completely eroding public trust. For communities already dealing with service backlogs, outages and crumbling infrastructure, the message feels deeply unfair.

“This crisis did not arise overnight,” Mashilompane said, pointing to a long-standing culture of non-payment combined with poor governance.

Who eventually pays?

The uncomfortable truth is that municipal debt doesn’t simply disappear. At some point, the bill lands somewhere and it’s unlikely to be painless.

Either residents face higher tariffs, levies and service charges, or municipalities slash projects, maintenance and upgrades because there’s no cash left. In a province already battling unemployment and rising living costs, neither option is attractive.

For now, Gauteng’s debt crisis sits at a crossroads. Without visible enforcement, political accountability and credible reforms, the fear is that financial strain will turn into full-blown municipal collapse, with ordinary residents left carrying the cost of years of failure they didn’t create.

{Source: The Citizen}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com