News

Public Debt Overshadows Health and Social Spending in SA’s 2023/24 Budget

Public Debt Dominates South Africa’s Spending Landscape

A deep dive into South Africa’s latest financial data shows that if you want to understand the government’s priorities, you need to follow the money. In 2023/24, public debt payments consumed R356 billion, more than the entire health budget and nearly matching social protection outlays.

According to Statistics South Africa’s Financial Statistics of Consolidated General Government, general government spending hit R2.4 trillion last year. Of this, general public services accounted for the largest share at 25%, followed by education at 20%, social protection at 15%, and health at 12%.

Debt Servicing Surpasses Critical Sectors

The cost of servicing South Africa’s R5.3 trillion gross loan debt was staggering, highlighting how debt management has become the biggest drain on government resources. For context, health received R276 billion and social protection R365 billion, putting debt servicing at the forefront of fiscal priorities.

Extra-budgetary allocations also played a role: an additional R23.4 billion was spent on economic affairs, mainly on rail and road infrastructure, while local municipalities contributed another R19.7 billion toward public services.

Social Protection and Grants See Modest Increases

Despite debt pressures, government increased spending on old age, family, child, and disability grants, adding R17.3 billion to social protection. Meanwhile, economic affairs saw the largest decline, down R39 billion, largely due to the base effect from the prior year’s capital transfer to Eskom.

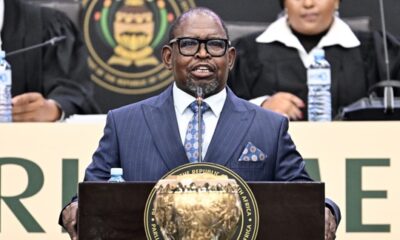

Finance Minister Enoch Godongwana stressed a shift toward infrastructure investment, aiming for over R1 trillion in public sector projects over the next three years.

Public-Private Partnerships Key to Ambitious Plans

Godongwana plans to leverage public-private partnerships to finance large-scale projects, tapping private capital to improve service delivery and economic growth. Michelle Green, ESG Committee chair at Prescient Investment Management, said these projects could transform sectors like energy, water, student housing, internet infrastructure, and logistics hubsif the government can create an investor-friendly environment.

A McKinsey report, The Infrastructure Moment, suggests South Africa could see R1.822 trillion in investment by 2040 if these initiatives succeed, marking a potential turning point in addressing the country’s long-term economic challenges.

Public Reaction and Context

South Africans on social media have noted the stark contrast between soaring debt payments and essential services, with many questioning the sustainability of current fiscal priorities. Analysts warn that while ambitious infrastructure spending could stimulate growth, debt levels remain a pressing concern that policymakers cannot ignore.

As South Africa navigates this complex financial landscape, the balance between managing debt and investing in the future will define the nation’s economic trajectory in the years to come.

{Source: IOL}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com