News

SARB Signals Door Open for Double Interest Rate Cuts as Inflation Remains Subdued

A lower inflation target, a potential interest rate boon

The South African Reserve Bank (SARB) has stirred optimism among homeowners and borrowers alike. By lowering its inflation target to 3%, at the lower end of the central bank’s 3–6% range, SARB has opened the door to potential double interest rate cuts over the next year or two.

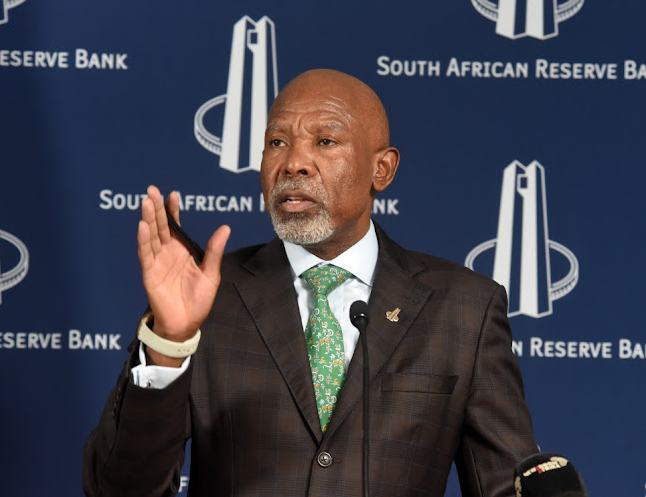

Governor Lesetja Kganyago confirmed that future rate decisions will now aim to maintain this new inflation benchmark, a shift from the previous midpoint target of 4.5%. While markets are cautiously optimistic, SARB’s Monetary Policy Committee (MPC) sees this adjustment paving the way for up to 100 basis points (bps) in repo rate cuts, potentially bringing the key rate down to 6% by the end of 2026.

Subdued inflation fuels the move

South Africa’s inflation has hovered around 3% for nearly a year, giving policymakers room to ease monetary policy. This allowed the SARB to already cut rates by a cumulative 125bps to 7% in 2025, and the new target may push rates even lower.

The logic is simple: as inflation eases, interest rates must follow to prevent the real, inflation-adjusted rate from climbing too high. SARB projections even suggest a “new normal” interest rate of 3% by 2027, assuming inflation remains in check and the rand remains stable.

Markets remain cautious

Despite SARB’s signals, markets have not fully embraced the central bank’s forecasts. The Forward Rate Agreement (FRA) shows only a 50bps drop by the end of 2026, reflecting uncertainty over whether the full 100bps reduction will materialize.

Investec Chief Economist Annabel Bishop noted that local markets have reacted minimally so far, with just a small 15bps dip in domestic bond yields, as global events, particularly US trade policies, continue to dominate investor attention.

Property market could be the big winner

For homebuyers and property investors, lower borrowing costs are welcome news. FNB Senior Economist Siphamandla Mkhwanazi says the combination of easing rates, stable inflation, and improving real wages could support housing demand, especially in the low- to middle-income segments.

South Africa’s housing market is already showing resilience. The latest FNB House Price Index recorded a 3.7% average increase, outpacing inflation and marking real gains in property values. Lower rates could further reinforce this upward trend, making mortgages more affordable and stimulating demand in key segments.

The balancing act

The SARB’s move underscores a delicate balancing act: stimulate growth without letting inflation creep higher. While Finance Minister Enoch Godongwana has expressed reservations about the new target, Kganyago appears confident that both sides will find agreement, allowing monetary policy to guide the economy more effectively.

For South Africans, the implications are clear: cheaper borrowing, steadier inflation, and potentially a healthier property market, all factors that could make everyday life a little easier in an economy long challenged by high costs and slow growth.

{Source: BusinessTech}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com