News

Xi says China wants the yuan to challenge the US dollar as a global reserve currency

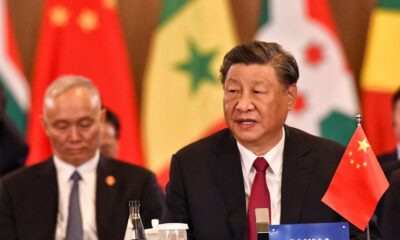

Xi makes a clear call on China’s financial future

China’s president, Xi Jinping, has set out one of his clearest economic ambitions yet: the Chinese yuan must grow into a true global reserve currency.

Writing in Qiushi, the official journal of the Communist Party, Xi argued that China cannot become a genuine financial powerhouse without a currency that is trusted, widely used, and held by central banks around the world. In his view, China’s financial system is already massive but still lacks the strength and influence needed to match its economic size.

At the heart of that strength, he says, is a powerful central bank and a yuan that plays a much bigger role in global trade, investment, and foreign exchange markets.

How the Ukraine war changed global money flows

The push for a stronger yuan did not appear out of nowhere. Since the escalation of the Ukraine conflict in early 2022, global trade patterns have shifted in quiet but meaningful ways. Sanctions on Russia forced many countries to look for alternatives to the US dollar, especially when trading with partners facing Western restrictions.

As a result, the yuan surged in trade finance usage and became the second most used currency in that space after the dollar. That rise reflected practical necessity more than ideology, but it opened the door for Beijing to argue that the world is ready for a more diverse monetary system.

Despite this progress, the yuan still plays only a small role in official foreign exchange reserves. According to data from the International Monetary Fund, the dollar held about 57 percent of global reserves in late 2025, the euro around 20 percent, and the yuan under 2 percent.

A warning shot at dollar dominance

Chinese officials have become more vocal about the risks of relying too heavily on the US dollar. Last year, central bank governor Pan Gongsheng warned that excessive dependence on a single currency exposes countries to political pressure and financial shocks. He suggested the global system is slowly moving toward one where several major currencies coexist, compete, and balance one another.

That view gained traction after Germany’s financial watchdog, the German Federal Financial Supervisory Authority, cautioned that the dollar’s reserve status could face challenges as early as 2026. Funding strains, geopolitical tension, and the growing use of sanctions were all cited as pressure points.

Market nerves were already visible when the Bloomberg Dollar Spot Index recorded its sharpest drop in months following the announcement of sweeping new tariffs by Donald Trump. Trump later brushed off concerns, insisting the dollar remained strong and should be allowed to find its own level.

Russia and China show what a post-dollar trade looks like

Perhaps the most concrete example of this shift is the deepening financial relationship between Beijing and Moscow. Russia’s finance minister Anton Siluanov confirmed that almost all trade between the two countries now takes place in rubles and yuan. The goal is simple: reduce exposure to Western financial systems and the risks that come with them.

For China, this is proof that alternative currency arrangements can work at scale. For critics, it also highlights the political nature of the yuan’s rise, which remains closely tied to state policy and capital controls.

What this means for the rest of the world

Xi’s comments signal long-term intent rather than an overnight shift. Reserve currency status is built on trust, transparency, and open markets, areas where China still faces scepticism. But the direction is clear. Beijing wants a seat at the very top of global finance, not just as a manufacturing hub or export giant, but as a rule setter in how money itself moves.

On social media, reactions have been mixed. Supporters see it as a necessary challenge to dollar dominance, especially for countries in the Global South. Others argue that without deeper financial liberalisation, the yuan’s global ambitions may remain limited.

What is certain is that the conversation around money is changing. Xi is no longer hinting at reform or balance. He is openly stating that China wants its currency to stand alongside the world’s most powerful.

Follow Joburg ETC on Facebook, Twitter, TikT

For more News in Johannesburg, visit joburgetc.com

Source: IOL

Featured Image: Business news from Ukraine