Business

US Tariffs to Hit South Africa’s Citrus and Grape Exports Hardest in the Western Cape

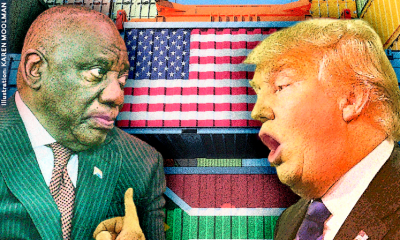

The United States’ looming 30% tariff on South African exports may not cripple the country’s economy as a whole — but it’s likely to hit hard at a regional level, especially within the Western Cape’s agricultural sector, experts have warned.

Announced by US President Donald Trump, the new tariffs follow a three-month reprieve that began in April 2025, aimed at allowing negotiations with impacted countries, including South Africa. But with that window now closing, analysts say it’s the citrus and table grape industries that could suffer the biggest losses.

“The national share of exports to the US is just 4%, but that number becomes significant when you zoom in on provinces and commodities,” said Louw Pienaar, senior analyst at the Bureau for Food and Agricultural Policy, during the Standard Bank Africa Unlocked Conference in Cape Town this week.

While minerals and vehicle exports will also feel the heat, it’s the agriculture sector’s vulnerability at the provincial level that has growers bracing for a harsh season.

Table Grapes, Citrus on the Frontline

According to the National Agricultural Marketing Council, South Africa’s top agricultural exports in 2024 were:

-

Grapes

-

Maize

-

Oranges

-

Mandarins

-

Apples

-

Wine

-

Lemons

Grapes and citrus, key exports to the US, are now particularly exposed. Francois Rossouw, managing director of Mooigezicht Estates, said import duties remain the single biggest barrier for local table grape exporters trying to compete globally.

“Our biggest southern hemisphere competitors, Chile, Peru, Australia, and Brazil, could divert their fruit from the US to the UK and Europe, flooding our traditional markets. We’re very concerned,” Rossouw said.

To mitigate the fallout, his company is preparing to pivot toward African markets. But shifting to new markets is not an overnight solution, and South African exporters still value access to high-income US consumers.

Why the US Still Matters for SA Agriculture

“The US is still one of our fastest-growing citrus markets,” said Louis van Ravesteyn, head of agribusiness at Standard Bank. “They pay well and in dollars, so yes, we need America just as much as we need the EU, UK and East Asia.”

He proposed a seasonal trade deal to reduce competition with US producers:

“If the US produces 80% of its citrus annually, allow us access during the other 20%, and apply reduced tariffs during that window.”

Van Ravesteyn also urged caution, saying South Africa must consider its obligations under the Southern African Customs Union (SACU), which includes Botswana, Eswatini, Lesotho and Namibia, all of whom share a common external tariff.

Domestic Reforms Are Equally Critical

Beyond external trade policy, Van Ravesteyn emphasised the need for domestic agricultural reform. South Africa has two million hectares of state-held land that could be redistributed to smallholder and emerging farmers, but land alone isn’t enough.

“We need to back this up with skills training, financial inclusion, and infrastructure support. These farmers must be able to work their land profitably. That’s how we build resilience,” he said.

Navigating an Uncertain Trade Future

As global competitors react to Trump’s tariffs and adjust their trade strategies, South Africa may find itself squeezed in multiple markets.

“Negotiation remains vital,” Pienaar said. “But we must also diversify and build our internal capacity to better withstand these external shocks.”

In the meantime, exporters are watching nervously, hoping government negotiators can secure better terms before the August 1 deadline.

{Source: Mail & Gaurdian}

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com